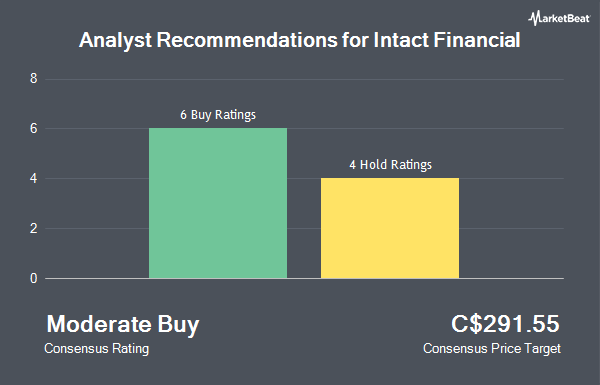

Intact Financial Co. (TSE:IFC - Get Free Report) has been given an average rating of "Moderate Buy" by the nine analysts that are currently covering the company, Marketbeat Ratings reports. Three analysts have rated the stock with a hold rating, five have issued a buy rating and one has given a strong buy rating to the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is C$322.20.

Several analysts have issued reports on the stock. Scotiabank upped their price target on shares of Intact Financial from C$318.00 to C$325.00 in a report on Wednesday, July 23rd. National Bankshares upped their price target on shares of Intact Financial from C$341.00 to C$350.00 and gave the company an "outperform" rating in a report on Tuesday, July 29th. Barclays raised shares of Intact Financial to a "strong-buy" rating in a report on Tuesday, September 30th. Royal Bank Of Canada reduced their price target on shares of Intact Financial from C$329.00 to C$324.00 and set a "sector perform" rating on the stock in a report on Thursday, July 31st. Finally, BMO Capital Markets boosted their price objective on shares of Intact Financial from C$330.00 to C$335.00 in a research report on Friday, July 11th.

Check Out Our Latest Stock Report on IFC

Intact Financial Price Performance

Shares of TSE IFC opened at C$258.62 on Friday. Intact Financial has a 12-month low of C$250.28 and a 12-month high of C$317.35. The company has a market capitalization of C$46.12 billion, a PE ratio of 19.85, a price-to-earnings-growth ratio of 2.01 and a beta of 0.14. The firm's 50-day moving average is C$272.11 and its two-hundred day moving average is C$290.74.

About Intact Financial

(

Get Free Report)

Intact Financial Corp is a property and casualty insurance company that provides written premiums in Canada. The company distributes insurance under the Intact Insurance brand through a network of brokers and a wholly-owned subsidiary, BrokerLink, and directly to consumers through Belairdirect. Most of the company's direct premiums are written in the personal automotive space.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Intact Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intact Financial wasn't on the list.

While Intact Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.