InterContinental Hotels Group (LON:IHG - Get Free Report) had its price objective raised by equities research analysts at Deutsche Bank Aktiengesellschaft from GBX 7,900 to GBX 8,050 in a research report issued on Thursday, Marketbeat Ratings reports. The brokerage presently has a "hold" rating on the stock. Deutsche Bank Aktiengesellschaft's target price suggests a potential downside of 7.57% from the company's current price.

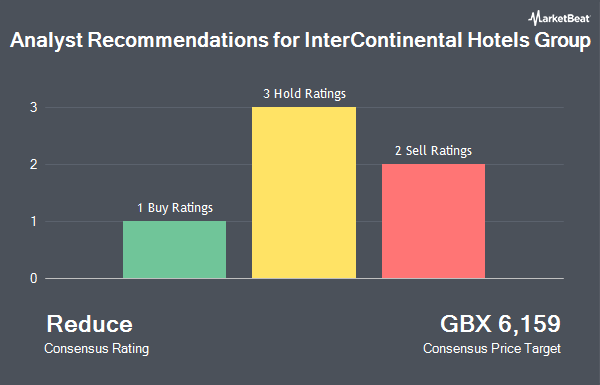

A number of other equities analysts have also recently issued reports on IHG. Citigroup lifted their target price on shares of InterContinental Hotels Group from GBX 7,800 to GBX 7,900 and gave the stock a "sell" rating in a research report on Tuesday, August 5th. JPMorgan Chase & Co. raised their price target on shares of InterContinental Hotels Group from GBX 8,300 to GBX 8,500 and gave the stock an "underweight" rating in a research note on Friday, August 8th. One equities research analyst has rated the stock with a Buy rating, two have given a Hold rating and two have issued a Sell rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Reduce" and a consensus target price of GBX 6,136.25.

Get Our Latest Research Report on InterContinental Hotels Group

InterContinental Hotels Group Price Performance

Shares of IHG traded down GBX 70.95 during trading hours on Thursday, reaching GBX 8,709.05. The company had a trading volume of 381,336 shares, compared to its average volume of 2,613,812. The firm has a 50 day simple moving average of GBX 8,816.57 and a 200-day simple moving average of GBX 8,545.21. The company has a current ratio of 0.85, a quick ratio of 1.35 and a debt-to-equity ratio of -162.30. The company has a market capitalization of £13.27 billion, a price-to-earnings ratio of 1,844.75, a PEG ratio of 1.69 and a beta of 0.98. InterContinental Hotels Group has a 12-month low of GBX 7,252 and a 12-month high of £109.75.

About InterContinental Hotels Group

(

Get Free Report)

Our presence

IHG® Hotels & Resorts is a global hospitality company,

with 19 hotel brands, one of the industry's largest

loyalty programmes, over 6,300 open hotels in more

than 100 countries, and a further 1,800 hotels in our

development pipeline.

Our ambition

To deliver industry-leading growth in our scale,

enterprise platform and performance, doing so

sustainably for all stakeholders, including our hotel

owners, guests and society as a whole.

Our strategy

To use our scale and expertise to create the

exceptional guest experiences and owner returns

needed to grow our brands in the industry's most

valuable markets and segments.

Featured Articles

Before you consider InterContinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterContinental Hotels Group wasn't on the list.

While InterContinental Hotels Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.