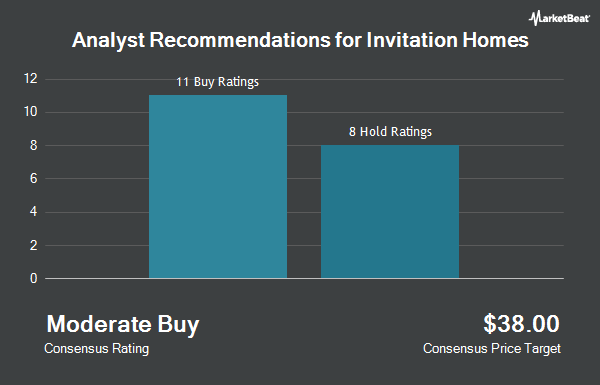

Invitation Home (NYSE:INVH - Get Free Report) has received an average recommendation of "Moderate Buy" from the seventeen research firms that are currently covering the firm, Marketbeat.com reports. Eight analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. The average 1-year target price among brokers that have issued ratings on the stock in the last year is $36.3438.

INVH has been the subject of several recent analyst reports. Evercore ISI reduced their price objective on shares of Invitation Home from $35.00 to $34.00 and set an "outperform" rating for the company in a research report on Monday, October 13th. Royal Bank Of Canada reduced their price target on shares of Invitation Home from $35.00 to $34.00 and set a "sector perform" rating for the company in a research report on Friday, August 1st. Scotiabank reduced their price target on shares of Invitation Home from $38.00 to $36.00 and set a "sector performer" rating for the company in a research report on Thursday, August 28th. Wells Fargo & Company reduced their price target on shares of Invitation Home from $33.00 to $31.00 and set an "equal weight" rating for the company in a research report on Monday, October 13th. Finally, Barclays reduced their price target on shares of Invitation Home from $40.00 to $37.00 and set an "overweight" rating for the company in a research report on Tuesday, August 12th.

Read Our Latest Stock Analysis on Invitation Home

Invitation Home Stock Performance

Shares of INVH stock opened at $28.51 on Friday. The company has a market cap of $17.48 billion, a price-to-earnings ratio of 32.40, a price-to-earnings-growth ratio of 2.84 and a beta of 0.81. Invitation Home has a 52 week low of $27.71 and a 52 week high of $35.80. The company has a quick ratio of 0.02, a current ratio of 0.02 and a debt-to-equity ratio of 0.47. The firm has a 50 day moving average of $29.69 and a 200-day moving average of $31.83.

Invitation Home (NYSE:INVH - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The company reported $0.48 EPS for the quarter, hitting the consensus estimate of $0.48. The company had revenue of $681.40 million during the quarter, compared to the consensus estimate of $675.01 million. Invitation Home had a net margin of 20.36% and a return on equity of 5.56%. The company's quarterly revenue was up 4.3% on a year-over-year basis. During the same quarter last year, the firm posted $0.47 EPS. Invitation Home has set its FY 2025 guidance at 1.880-1.940 EPS. On average, equities analysts forecast that Invitation Home will post 1.83 earnings per share for the current year.

Invitation Home Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, October 17th. Investors of record on Thursday, September 25th were given a $0.29 dividend. The ex-dividend date of this dividend was Thursday, September 25th. This represents a $1.16 annualized dividend and a yield of 4.1%. Invitation Home's dividend payout ratio (DPR) is presently 131.82%.

Institutional Trading of Invitation Home

Several hedge funds have recently bought and sold shares of the business. Vanguard Group Inc. boosted its holdings in Invitation Home by 0.8% during the 2nd quarter. Vanguard Group Inc. now owns 95,026,266 shares of the company's stock worth $3,116,862,000 after acquiring an additional 719,365 shares during the last quarter. Norges Bank purchased a new position in Invitation Home during the 2nd quarter worth $1,693,992,000. State Street Corp boosted its holdings in Invitation Home by 1.3% during the 2nd quarter. State Street Corp now owns 36,159,024 shares of the company's stock worth $1,196,334,000 after acquiring an additional 460,747 shares during the last quarter. Geode Capital Management LLC boosted its holdings in Invitation Home by 2.0% during the 2nd quarter. Geode Capital Management LLC now owns 15,855,732 shares of the company's stock worth $518,018,000 after acquiring an additional 309,953 shares during the last quarter. Finally, Daiwa Securities Group Inc. boosted its holdings in Invitation Home by 4.0% during the 2nd quarter. Daiwa Securities Group Inc. now owns 13,319,490 shares of the company's stock worth $436,880,000 after acquiring an additional 514,100 shares during the last quarter. Institutional investors and hedge funds own 96.79% of the company's stock.

Invitation Home Company Profile

(

Get Free Report)

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company's mission, Together with you, we make a house a home, reflects its commitment to providing homes where individuals and families can thrive and high-touch service that continuously enhances residents' living experiences.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Invitation Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invitation Home wasn't on the list.

While Invitation Home currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.