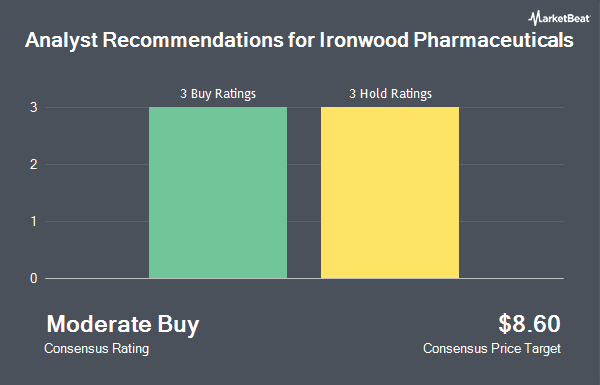

Shares of Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD - Get Free Report) have received an average rating of "Hold" from the seven research firms that are presently covering the firm, Marketbeat Ratings reports. Six analysts have rated the stock with a hold rating and one has given a buy rating to the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $4.94.

Separately, Wall Street Zen raised shares of Ironwood Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a research note on Saturday, August 9th.

View Our Latest Stock Analysis on IRWD

Ironwood Pharmaceuticals Stock Performance

IRWD traded up $0.09 on Thursday, hitting $1.12. 569,063 shares of the company were exchanged, compared to its average volume of 2,872,216. The stock has a market capitalization of $180.43 million, a PE ratio of -22.30 and a beta of 0.33. Ironwood Pharmaceuticals has a 12 month low of $0.53 and a 12 month high of $5.21. The firm has a fifty day simple moving average of $0.78 and a two-hundred day simple moving average of $1.06.

Ironwood Pharmaceuticals (NASDAQ:IRWD - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The biotechnology company reported $0.14 earnings per share for the quarter, topping analysts' consensus estimates of ($0.02) by $0.16. The firm had revenue of $85.24 million for the quarter, compared to analyst estimates of $62.02 million. Ironwood Pharmaceuticals had a negative return on equity of 2.46% and a negative net margin of 2.25%. On average, equities analysts expect that Ironwood Pharmaceuticals will post 0.1 earnings per share for the current year.

Institutional Investors Weigh In On Ironwood Pharmaceuticals

Hedge funds have recently made changes to their positions in the company. Point72 Asia Singapore Pte. Ltd. bought a new stake in shares of Ironwood Pharmaceuticals during the fourth quarter valued at approximately $36,000. Envestnet Asset Management Inc. purchased a new position in Ironwood Pharmaceuticals during the fourth quarter valued at $50,000. Boothbay Fund Management LLC purchased a new position in Ironwood Pharmaceuticals during the fourth quarter valued at $57,000. Wealth Enhancement Advisory Services LLC purchased a new position in Ironwood Pharmaceuticals during the fourth quarter valued at $59,000. Finally, Raymond James Financial Inc. purchased a new position in Ironwood Pharmaceuticals during the fourth quarter valued at $68,000.

About Ironwood Pharmaceuticals

(

Get Free Report)

Ironwood Pharmaceuticals, Inc, a healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products. It markets linaclotide, a guanylate cyclase type-C (GC-C) agonist for the treatment of adults suffering from irritable bowel syndrome with constipation or chronic idiopathic constipation under the LINZESS name in the United States, Mexico, Japan, Saudi Arabia, and China, as well as under the CONSTELLA name in the Canada and European countries.

Featured Stories

Before you consider Ironwood Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ironwood Pharmaceuticals wasn't on the list.

While Ironwood Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.