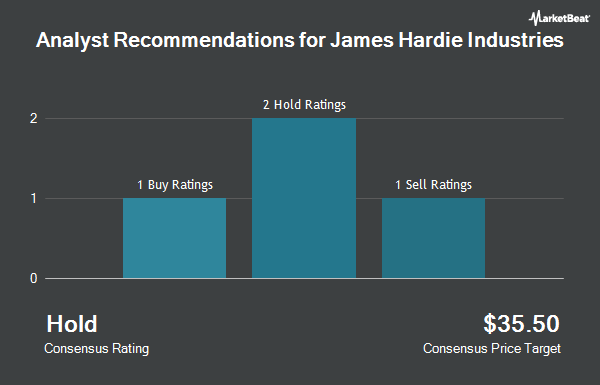

James Hardie Industries PLC. (NYSE:JHX - Get Free Report) has been assigned a consensus recommendation of "Buy" from the ten research firms that are covering the company, Marketbeat Ratings reports. One analyst has rated the stock with a hold recommendation, eight have assigned a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12 month price target among analysts that have issued a report on the stock in the last year is $33.27.

A number of brokerages have commented on JHX. Truist Financial cut their price target on shares of James Hardie Industries from $35.00 to $25.00 and set a "buy" rating on the stock in a research report on Wednesday, August 20th. Jefferies Financial Group started coverage on shares of James Hardie Industries in a research report on Friday, August 8th. They set a "buy" rating and a $34.00 price objective for the company. Macquarie raised shares of James Hardie Industries from a "neutral" rating to an "outperform" rating in a research report on Monday, July 28th. Wall Street Zen downgraded shares of James Hardie Industries from a "buy" rating to a "hold" rating in a research note on Wednesday, May 21st. Finally, Baird R W raised shares of James Hardie Industries to a "strong-buy" rating in a research note on Friday, July 11th.

View Our Latest Research Report on James Hardie Industries

James Hardie Industries Stock Performance

Shares of James Hardie Industries stock opened at $20.02 on Monday. The company has a debt-to-equity ratio of 1.12, a current ratio of 3.76 and a quick ratio of 3.31. The firm has a market capitalization of $8.61 billion, a P/E ratio of 26.00, a P/E/G ratio of 2.35 and a beta of 1.75. The company's 50 day moving average price is $24.77 and its two-hundred day moving average price is $25.24. James Hardie Industries has a fifty-two week low of $17.91 and a fifty-two week high of $43.57.

James Hardie Industries (NYSE:JHX - Get Free Report) last issued its quarterly earnings results on Tuesday, August 19th. The construction company reported $0.29 EPS for the quarter, missing analysts' consensus estimates of $0.36 by ($0.07). The firm had revenue of $899.90 million for the quarter, compared to the consensus estimate of $982.60 million. James Hardie Industries had a net margin of 8.75% and a return on equity of 27.95%. The business's revenue was down 9.3% compared to the same quarter last year. During the same period last year, the company posted $0.41 EPS. On average, equities analysts forecast that James Hardie Industries will post 1.39 earnings per share for the current fiscal year.

Institutional Investors Weigh In On James Hardie Industries

Several hedge funds and other institutional investors have recently bought and sold shares of JHX. TD Private Client Wealth LLC increased its stake in James Hardie Industries by 70.4% in the second quarter. TD Private Client Wealth LLC now owns 1,101 shares of the construction company's stock valued at $30,000 after purchasing an additional 455 shares in the last quarter. Hantz Financial Services Inc. increased its stake in James Hardie Industries by 641.2% in the second quarter. Hantz Financial Services Inc. now owns 1,223 shares of the construction company's stock valued at $33,000 after purchasing an additional 1,058 shares in the last quarter. MAI Capital Management grew its holdings in shares of James Hardie Industries by 4,266.7% during the second quarter. MAI Capital Management now owns 1,310 shares of the construction company's stock valued at $35,000 after buying an additional 1,280 shares during the last quarter. Northwestern Mutual Wealth Management Co. grew its holdings in shares of James Hardie Industries by 11,238.5% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 1,474 shares of the construction company's stock valued at $40,000 after buying an additional 1,461 shares during the last quarter. Finally, AlphaCore Capital LLC acquired a new position in shares of James Hardie Industries during the second quarter valued at about $52,000. 7.96% of the stock is owned by institutional investors.

James Hardie Industries Company Profile

(

Get Free Report)

James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded building products for interior and exterior building construction applications primarily in the United States, Australia, Europe, New Zealand, and the Philippines. The company operates through North America Fiber Cement, Asia Pacific Fiber Cement, and Europe Building Products segments.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider James Hardie Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and James Hardie Industries wasn't on the list.

While James Hardie Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.