Equities research analysts at Jefferies Financial Group began coverage on shares of Figure Technology Solutions (NASDAQ:FIGR - Get Free Report) in a report issued on Monday,Benzinga reports. The firm set a "hold" rating and a $40.00 price target on the stock. Jefferies Financial Group's price objective points to a potential downside of 0.74% from the stock's previous close.

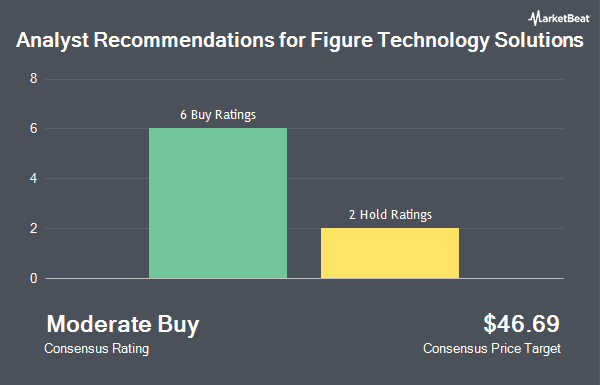

FIGR has been the topic of several other reports. Keefe, Bruyette & Woods assumed coverage on Figure Technology Solutions in a research note on Monday. They set an "outperform" rating and a $48.50 price objective on the stock. The Goldman Sachs Group began coverage on shares of Figure Technology Solutions in a research report on Monday. They set a "buy" rating and a $42.00 price objective for the company. Piper Sandler started coverage on shares of Figure Technology Solutions in a research note on Monday. They set an "overweight" rating and a $50.00 price objective on the stock. Wall Street Zen upgraded Figure Technology Solutions to a "hold" rating in a research note on Monday, September 22nd. Finally, Mizuho began coverage on Figure Technology Solutions in a report on Monday. They set an "outperform" rating and a $47.00 target price for the company. Six equities research analysts have rated the stock with a Buy rating and two have given a Hold rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $46.69.

View Our Latest Report on FIGR

Figure Technology Solutions Trading Down 2.4%

Shares of NASDAQ FIGR opened at $40.30 on Monday. Figure Technology Solutions has a 52-week low of $30.01 and a 52-week high of $46.20.

Insider Activity at Figure Technology Solutions

In other news, CEO Michael Benjamin Tannenbaum sold 297,171 shares of Figure Technology Solutions stock in a transaction on Friday, September 12th. The stock was sold at an average price of $25.00, for a total transaction of $7,429,275.00. Following the transaction, the chief executive officer owned 4,092,576 shares in the company, valued at approximately $102,314,400. The trade was a 6.77% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Adam Gilbert Boyden sold 468,860 shares of the stock in a transaction dated Friday, September 12th. The stock was sold at an average price of $25.00, for a total value of $11,721,500.00. Following the completion of the sale, the director directly owned 6,651,158 shares of the company's stock, valued at approximately $166,278,950. This represents a 6.59% decrease in their ownership of the stock. The disclosure for this sale can be found here.

Figure Technology Solutions Company Profile

(

Get Free Report)

Figure is building the future of capital markets using blockchain-based technology. Figure's proprietary technology powers next-generation lending, trading and investing activities in areas such as consumer credit and digital assets. Our application of the blockchain ledger allows us to better serve our end-customers, improve speed and efficiency, and enhance standardization and liquidity.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Figure Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Figure Technology Solutions wasn't on the list.

While Figure Technology Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.