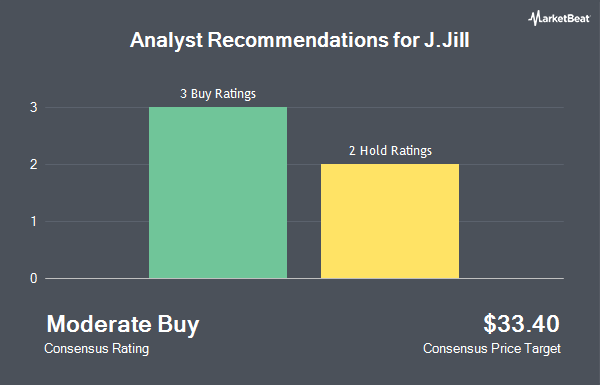

J.Jill, Inc. (NYSE:JILL - Get Free Report) has been given a consensus rating of "Hold" by the six research firms that are covering the stock, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and two have given a buy rating to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is $20.00.

Several research firms have recently weighed in on JILL. BTIG Research set a $26.00 target price on shares of J.Jill in a report on Thursday, September 4th. TD Cowen lifted their target price on shares of J.Jill from $16.00 to $17.00 and gave the company a "hold" rating in a report on Thursday, September 4th. Zacks Research lowered shares of J.Jill from a "hold" rating to a "strong sell" rating in a report on Monday, September 15th. Cowen reaffirmed a "hold" rating on shares of J.Jill in a report on Thursday, September 4th. Finally, Telsey Advisory Group reissued a "market perform" rating and issued a $17.00 price target on shares of J.Jill in a report on Wednesday, September 3rd.

View Our Latest Report on J.Jill

Hedge Funds Weigh In On J.Jill

A number of institutional investors and hedge funds have recently bought and sold shares of JILL. Royce & Associates LP boosted its position in J.Jill by 33.3% during the first quarter. Royce & Associates LP now owns 768,127 shares of the specialty retailer's stock worth $15,002,000 after acquiring an additional 192,096 shares during the last quarter. Fund 1 Investments LLC grew its holdings in shares of J.Jill by 22.8% in the second quarter. Fund 1 Investments LLC now owns 936,248 shares of the specialty retailer's stock valued at $13,707,000 after purchasing an additional 173,785 shares during the period. Marshall Wace LLP grew its holdings in shares of J.Jill by 931.8% in the second quarter. Marshall Wace LLP now owns 147,892 shares of the specialty retailer's stock valued at $2,165,000 after purchasing an additional 133,558 shares during the period. Paradigm Capital Management Inc. NY grew its holdings in shares of J.Jill by 13.5% in the second quarter. Paradigm Capital Management Inc. NY now owns 1,057,300 shares of the specialty retailer's stock valued at $15,479,000 after purchasing an additional 125,838 shares during the period. Finally, Segall Bryant & Hamill LLC purchased a new stake in shares of J.Jill in the first quarter valued at about $1,313,000. 40.71% of the stock is currently owned by institutional investors and hedge funds.

J.Jill Stock Down 0.5%

JILL stock opened at $16.72 on Friday. The firm has a 50 day moving average of $16.84 and a 200 day moving average of $16.34. The stock has a market capitalization of $254.57 million, a PE ratio of 6.99 and a beta of 0.90. The company has a quick ratio of 0.64, a current ratio of 1.11 and a debt-to-equity ratio of 0.58. J.Jill has a 52 week low of $13.36 and a 52 week high of $30.40.

J.Jill (NYSE:JILL - Get Free Report) last announced its quarterly earnings data on Wednesday, September 3rd. The specialty retailer reported $0.81 EPS for the quarter, beating the consensus estimate of $0.72 by $0.09. J.Jill had a net margin of 6.12% and a return on equity of 40.48%. The business had revenue of $153.99 million during the quarter, compared to analysts' expectations of $148.02 million. Sell-side analysts forecast that J.Jill will post 3.36 earnings per share for the current year.

J.Jill Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, October 1st. Investors of record on Wednesday, September 17th were issued a $0.08 dividend. This represents a $0.32 annualized dividend and a yield of 1.9%. The ex-dividend date of this dividend was Wednesday, September 17th. J.Jill's payout ratio is presently 13.39%.

J.Jill Company Profile

(

Get Free Report)

J.Jill, Inc operates as an omnichannel retailer for women's apparel under the J.Jill brand in the United States. It offers apparel, footwear, and accessories, including scarves and jewelry. The company markets its products through retail stores, website, and catalogs. J.Jill, Inc was founded in 1959 and is headquartered in Quincy, Massachusetts.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider J.Jill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J.Jill wasn't on the list.

While J.Jill currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.