LGI Homes (NASDAQ:LGIH - Get Free Report) had its price target lowered by equities researchers at JMP Securities from $140.00 to $75.00 in a report issued on Thursday, August 7th, MarketBeat reports. The brokerage presently has a "market outperform" rating on the financial services provider's stock. JMP Securities' price target would suggest a potential upside of 11.94% from the stock's previous close.

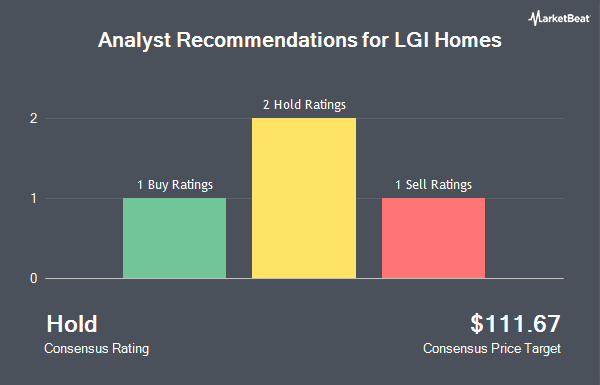

LGIH has been the topic of several other reports. JPMorgan Chase & Co. lowered their price target on shares of LGI Homes from $52.00 to $47.00 and set an "underweight" rating on the stock in a report on Wednesday, July 9th. Wedbush reaffirmed a "neutral" rating and issued a $93.00 price target on shares of LGI Homes in a report on Monday, July 7th. Finally, Citigroup reissued an "outperform" rating on shares of LGI Homes in a research note on Thursday, August 7th. One analyst has rated the stock with a sell rating, two have given a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $71.67.

Get Our Latest Stock Analysis on LGIH

LGI Homes Price Performance

Shares of LGIH opened at $67.00 on Thursday. The firm has a market capitalization of $1.55 billion, a PE ratio of 10.10 and a beta of 1.69. The company has a debt-to-equity ratio of 0.85, a current ratio of 18.18 and a quick ratio of 0.64. LGI Homes has a 1-year low of $47.17 and a 1-year high of $125.83. The company's fifty day moving average price is $54.08 and its 200-day moving average price is $62.21.

LGI Homes (NASDAQ:LGIH - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The financial services provider reported $1.36 earnings per share for the quarter, beating analysts' consensus estimates of $1.21 by $0.15. The firm had revenue of $483.49 million for the quarter, compared to analyst estimates of $546.96 million. LGI Homes had a net margin of 7.63% and a return on equity of 8.00%. The business's quarterly revenue was down 19.8% compared to the same quarter last year. During the same period in the previous year, the company earned $2.48 earnings per share. On average, equities research analysts predict that LGI Homes will post 8.46 EPS for the current year.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of the stock. MassMutual Private Wealth & Trust FSB raised its holdings in LGI Homes by 453.1% in the 2nd quarter. MassMutual Private Wealth & Trust FSB now owns 531 shares of the financial services provider's stock valued at $27,000 after acquiring an additional 435 shares during the last quarter. Russell Investments Group Ltd. raised its holdings in LGI Homes by 106.6% in the 2nd quarter. Russell Investments Group Ltd. now owns 591 shares of the financial services provider's stock valued at $30,000 after acquiring an additional 305 shares during the last quarter. Caitong International Asset Management Co. Ltd raised its holdings in LGI Homes by 12,620.0% in the 1st quarter. Caitong International Asset Management Co. Ltd now owns 636 shares of the financial services provider's stock valued at $42,000 after acquiring an additional 631 shares during the last quarter. Signaturefd LLC raised its holdings in LGI Homes by 284.4% in the 2nd quarter. Signaturefd LLC now owns 815 shares of the financial services provider's stock valued at $42,000 after acquiring an additional 603 shares during the last quarter. Finally, Sterling Capital Management LLC raised its holdings in LGI Homes by 801.5% in the 4th quarter. Sterling Capital Management LLC now owns 613 shares of the financial services provider's stock valued at $55,000 after acquiring an additional 545 shares during the last quarter. Institutional investors and hedge funds own 84.89% of the company's stock.

About LGI Homes

(

Get Free Report)

LGI Homes, Inc designs, constructs, and sells homes. It offers entry-level homes, such as attached and detached homes, and active adult homes under the LGI Homes brand name; and luxury series homes under the Terrata Homes brand name. The company also engages in the wholesale business, which include building and selling homes to large institutions looking to acquire single-family rental properties.

Recommended Stories

Before you consider LGI Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LGI Homes wasn't on the list.

While LGI Homes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.