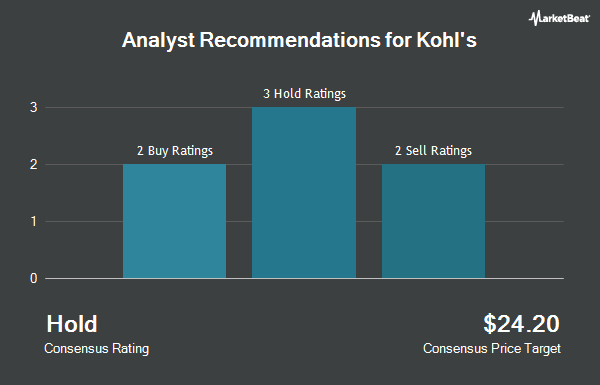

Kohl's Corporation (NYSE:KSS - Get Free Report) has earned a consensus recommendation of "Reduce" from the fifteen analysts that are covering the firm, Marketbeat Ratings reports. Seven investment analysts have rated the stock with a sell rating and eight have assigned a hold rating to the company. The average 1 year price objective among analysts that have covered the stock in the last year is $9.8929.

Several brokerages have commented on KSS. Evercore ISI dropped their price target on shares of Kohl's from $9.00 to $8.00 and set an "in-line" rating on the stock in a research note on Friday, May 2nd. Barclays increased their price target on shares of Kohl's from $4.00 to $5.00 and gave the company an "underweight" rating in a research note on Friday, May 30th. JPMorgan Chase & Co. increased their price target on shares of Kohl's from $8.00 to $10.00 and gave the company an "underweight" rating in a research note on Monday, July 28th. Wall Street Zen downgraded Kohl's from a "hold" rating to a "sell" rating in a report on Sunday, June 22nd. Finally, Robert W. Baird raised their target price on shares of Kohl's from $8.00 to $9.00 and gave the stock a "neutral" rating in a research report on Friday, May 30th.

Check Out Our Latest Research Report on Kohl's

Kohl's Stock Up 9.9%

KSS stock opened at $12.22 on Tuesday. The company's 50 day moving average price is $9.83 and its 200 day moving average price is $9.38. The company has a debt-to-equity ratio of 0.95, a quick ratio of 0.14 and a current ratio of 1.09. Kohl's has a fifty-two week low of $6.04 and a fifty-two week high of $21.39. The firm has a market capitalization of $1.37 billion, a price-to-earnings ratio of 11.21 and a beta of 1.73.

Kohl's (NYSE:KSS - Get Free Report) last announced its quarterly earnings results on Thursday, May 29th. The company reported ($0.13) EPS for the quarter, beating the consensus estimate of ($0.22) by $0.09. The company had revenue of $3.05 billion for the quarter, compared to analyst estimates of $3.01 billion. Kohl's had a net margin of 0.75% and a return on equity of 4.71%. The firm's revenue was down 4.1% on a year-over-year basis. During the same period in the prior year, the firm posted ($0.24) earnings per share. On average, equities research analysts anticipate that Kohl's will post 1.3 EPS for the current fiscal year.

Kohl's Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, June 25th. Investors of record on Wednesday, June 11th were given a $0.125 dividend. This represents a $0.50 dividend on an annualized basis and a yield of 4.1%. The ex-dividend date was Wednesday, June 11th. Kohl's's dividend payout ratio (DPR) is 45.87%.

Hedge Funds Weigh In On Kohl's

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. LPL Financial LLC boosted its position in shares of Kohl's by 45.9% during the 4th quarter. LPL Financial LLC now owns 65,235 shares of the company's stock worth $916,000 after purchasing an additional 20,537 shares in the last quarter. Franklin Resources Inc. boosted its position in shares of Kohl's by 128.5% during the 4th quarter. Franklin Resources Inc. now owns 103,236 shares of the company's stock worth $1,449,000 after purchasing an additional 58,057 shares in the last quarter. Russell Investments Group Ltd. boosted its position in shares of Kohl's by 7.6% during the 4th quarter. Russell Investments Group Ltd. now owns 17,526 shares of the company's stock worth $246,000 after purchasing an additional 1,232 shares in the last quarter. Bank of Montreal Can boosted its position in shares of Kohl's by 20.3% during the 4th quarter. Bank of Montreal Can now owns 27,783 shares of the company's stock worth $390,000 after purchasing an additional 4,694 shares in the last quarter. Finally, Invesco Ltd. boosted its position in shares of Kohl's by 1.6% during the 4th quarter. Invesco Ltd. now owns 2,292,746 shares of the company's stock worth $32,190,000 after purchasing an additional 36,622 shares in the last quarter. 98.04% of the stock is currently owned by hedge funds and other institutional investors.

Kohl's Company Profile

(

Get Free Report)

Kohl's Corporation operates as an omnichannel retailer in the United States. It offers branded apparel, footwear, accessories, beauty, and home products through its stores and website. The company provides its products primarily under the brand names of Croft & Barrow, Jumping Beans, SO, Sonoma Goods for Life, and Tek Gear, as well as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kohl's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kohl's wasn't on the list.

While Kohl's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.