Kosmos Energy (NYSE:KOS - Free Report) had its price objective cut by Mizuho from $3.00 to $2.00 in a report released on Monday morning,Benzinga reports. They currently have a neutral rating on the oil and gas producer's stock.

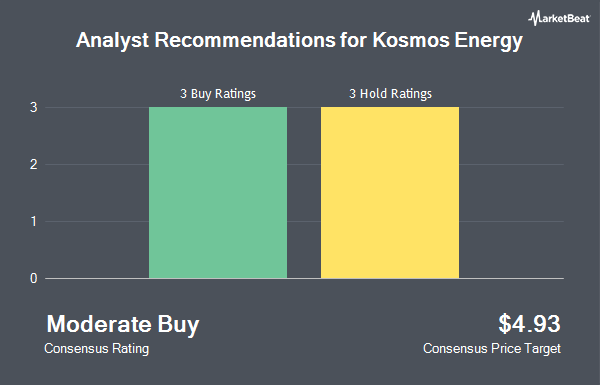

A number of other equities research analysts also recently commented on the company. Benchmark reiterated a "hold" rating on shares of Kosmos Energy in a research report on Thursday, June 5th. The Goldman Sachs Group decreased their target price on Kosmos Energy from $3.50 to $3.00 and set a "buy" rating on the stock in a research report on Monday, May 19th. Three research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $4.77.

Get Our Latest Stock Analysis on KOS

Kosmos Energy Price Performance

Shares of Kosmos Energy stock traded down $0.07 during trading hours on Monday, hitting $1.69. The company's stock had a trading volume of 8,458,849 shares, compared to its average volume of 9,961,006. The business has a 50 day moving average price of $1.87 and a two-hundred day moving average price of $1.90. Kosmos Energy has a 12-month low of $1.39 and a 12-month high of $4.69. The company has a market cap of $805.85 million, a PE ratio of -5.11 and a beta of 1.57. The company has a debt-to-equity ratio of 2.56, a quick ratio of 0.25 and a current ratio of 0.45.

Kosmos Energy (NYSE:KOS - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The oil and gas producer reported ($0.19) EPS for the quarter, missing the consensus estimate of ($0.06) by ($0.13). Kosmos Energy had a negative net margin of 10.74% and a negative return on equity of 14.16%. The business had revenue of $393.52 million during the quarter, compared to analysts' expectations of $444.26 million. Analysts expect that Kosmos Energy will post 0.42 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of KOS. Ameriprise Financial Inc. grew its stake in shares of Kosmos Energy by 16.0% during the fourth quarter. Ameriprise Financial Inc. now owns 2,052,533 shares of the oil and gas producer's stock valued at $7,020,000 after buying an additional 282,363 shares during the last quarter. Deutsche Bank AG grew its stake in Kosmos Energy by 28.3% in the fourth quarter. Deutsche Bank AG now owns 814,366 shares of the oil and gas producer's stock worth $2,785,000 after purchasing an additional 179,618 shares in the last quarter. D. E. Shaw & Co. Inc. grew its stake in Kosmos Energy by 138.0% in the fourth quarter. D. E. Shaw & Co. Inc. now owns 35,700 shares of the oil and gas producer's stock worth $122,000 after purchasing an additional 20,700 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in Kosmos Energy by 3.9% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 266,037 shares of the oil and gas producer's stock worth $910,000 after purchasing an additional 9,928 shares in the last quarter. Finally, Millennium Management LLC grew its stake in Kosmos Energy by 78.2% in the fourth quarter. Millennium Management LLC now owns 2,665,589 shares of the oil and gas producer's stock worth $9,116,000 after purchasing an additional 1,170,074 shares in the last quarter. Institutional investors own 95.33% of the company's stock.

Kosmos Energy Company Profile

(

Get Free Report)

Kosmos Energy Ltd., together with its subsidiaries, engages in the exploration, development, and production of oil and gas along the Atlantic Margins in the United States. The company's primary assets include production projects located in offshore Ghana, Equatorial Guinea, and the U.S. Gulf of Mexico, as well as gas projects located in offshore Mauritania and Senegal.

Featured Articles

Before you consider Kosmos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kosmos Energy wasn't on the list.

While Kosmos Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.