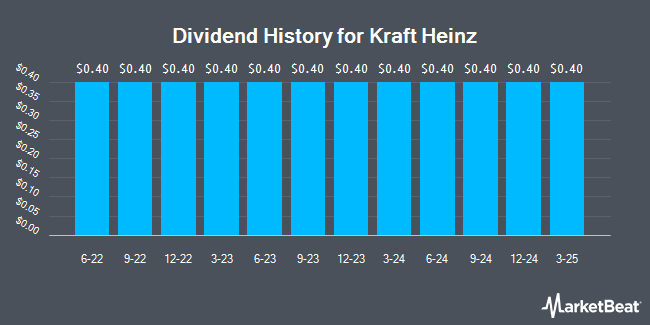

Kraft Heinz Company (NASDAQ:KHC - Get Free Report) announced a quarterly dividend on Wednesday, July 30th, RTT News reports. Investors of record on Friday, August 29th will be paid a dividend of 0.40 per share on Friday, September 26th. This represents a c) dividend on an annualized basis and a yield of 5.9%. The ex-dividend date is Friday, August 29th.

Kraft Heinz has a dividend payout ratio of 59.9% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect Kraft Heinz to earn $2.82 per share next year, which means the company should continue to be able to cover its $1.60 annual dividend with an expected future payout ratio of 56.7%.

Kraft Heinz Stock Performance

Shares of NASDAQ:KHC traded down $0.33 during trading on Friday, hitting $27.13. 2,123,240 shares of the company were exchanged, compared to its average volume of 12,425,968. Kraft Heinz has a 52-week low of $25.44 and a 52-week high of $36.53. The stock has a 50 day moving average of $26.84 and a 200 day moving average of $28.54. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.07 and a quick ratio of 0.81. The company has a market cap of $32.11 billion, a PE ratio of -6.04, a P/E/G ratio of 3.34 and a beta of 0.25.

Kraft Heinz (NASDAQ:KHC - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The company reported $0.69 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.64 by $0.05. The firm had revenue of $6.35 billion during the quarter, compared to analyst estimates of $6.26 billion. Kraft Heinz had a positive return on equity of 7.40% and a negative net margin of 20.83%. The company's revenue was down 1.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.78 earnings per share. As a group, equities research analysts predict that Kraft Heinz will post 2.68 EPS for the current year.

Insider Buying and Selling at Kraft Heinz

In other Kraft Heinz news, Director Elio Leoni Sceti sold 25,000 shares of the stock in a transaction dated Friday, July 18th. The stock was sold at an average price of $27.91, for a total value of $697,750.00. Following the sale, the director owned 40,000 shares of the company's stock, valued at $1,116,400. This trade represents a 38.46% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Company insiders own 0.35% of the company's stock.

Hedge Funds Weigh In On Kraft Heinz

Several hedge funds have recently added to or reduced their stakes in the stock. Hara Capital LLC boosted its holdings in shares of Kraft Heinz by 61.9% in the fourth quarter. Hara Capital LLC now owns 1,700 shares of the company's stock valued at $52,000 after acquiring an additional 650 shares during the period. O Shaughnessy Asset Management LLC boosted its stake in shares of Kraft Heinz by 45.6% in the fourth quarter. O Shaughnessy Asset Management LLC now owns 85,122 shares of the company's stock valued at $2,614,000 after buying an additional 26,641 shares in the last quarter. Wellington Management Group LLP grew its stake in shares of Kraft Heinz by 39.6% during the 4th quarter. Wellington Management Group LLP now owns 176,864 shares of the company's stock worth $5,431,000 after purchasing an additional 50,211 shares during the period. Geode Capital Management LLC increased its holdings in Kraft Heinz by 3.1% in the fourth quarter. Geode Capital Management LLC now owns 19,745,734 shares of the company's stock valued at $604,644,000 after buying an additional 595,406 shares in the last quarter. Finally, Bryce Point Capital LLC purchased a new stake in Kraft Heinz during the fourth quarter worth $818,000. 78.17% of the stock is currently owned by hedge funds and other institutional investors.

Kraft Heinz Company Profile

(

Get Free Report)

The Kraft Heinz Company, together with its subsidiaries, manufactures and markets food and beverage products in North America and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Maxwell House, Kool-Aid, Jell-O, Heinz, ABC, Master, Quero, Kraft, Golden Circle, Wattie's, Pudliszki, and Plasmon brands.

Read More

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.