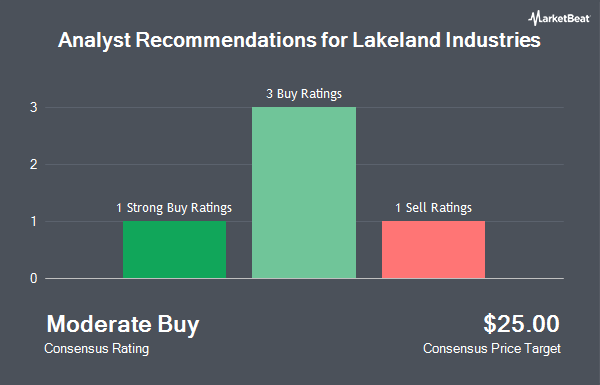

Shares of Lakeland Industries, Inc. (NASDAQ:LAKE - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the five analysts that are currently covering the stock, Marketbeat reports. One equities research analyst has rated the stock with a sell rating, three have given a buy rating and one has issued a strong buy rating on the company. The average 1-year price objective among brokers that have updated their coverage on the stock in the last year is $25.00.

A number of equities research analysts have issued reports on the company. Zacks Research raised Lakeland Industries from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, September 17th. Wall Street Zen raised Lakeland Industries from a "sell" rating to a "hold" rating in a research report on Saturday, September 13th. Lake Street Capital set a $26.00 target price on Lakeland Industries and gave the stock a "buy" rating in a research report on Tuesday, June 10th. DA Davidson decreased their target price on Lakeland Industries from $23.00 to $20.00 and set a "buy" rating for the company in a research report on Thursday, September 11th. Finally, Weiss Ratings reaffirmed a "sell (d)" rating on shares of Lakeland Industries in a research report on Saturday, September 27th.

View Our Latest Report on LAKE

Institutional Inflows and Outflows

Institutional investors have recently modified their holdings of the business. Salem Investment Counselors Inc. acquired a new position in shares of Lakeland Industries in the second quarter worth about $28,000. Police & Firemen s Retirement System of New Jersey acquired a new position in shares of Lakeland Industries in the second quarter worth about $31,000. Bank of America Corp DE lifted its stake in shares of Lakeland Industries by 189.9% in the second quarter. Bank of America Corp DE now owns 4,177 shares of the medical instruments supplier's stock worth $57,000 after acquiring an additional 2,736 shares in the last quarter. JPMorgan Chase & Co. acquired a new position in shares of Lakeland Industries in the second quarter worth about $59,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. acquired a new position in shares of Lakeland Industries in the second quarter worth about $68,000. Institutional investors and hedge funds own 71.69% of the company's stock.

Lakeland Industries Trading Up 4.4%

LAKE stock traded up $0.65 during trading on Friday, reaching $15.43. 128,523 shares of the stock traded hands, compared to its average volume of 128,042. The business's 50 day moving average price is $14.71 and its 200-day moving average price is $15.92. Lakeland Industries has a 52-week low of $12.76 and a 52-week high of $27.28. The company has a debt-to-equity ratio of 0.19, a current ratio of 3.66 and a quick ratio of 1.41. The firm has a market capitalization of $147.68 million, a PE ratio of -5.63 and a beta of 1.11.

Lakeland Industries (NASDAQ:LAKE - Get Free Report) last posted its quarterly earnings results on Tuesday, September 9th. The medical instruments supplier reported $0.36 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.04) by $0.40. Lakeland Industries had a negative return on equity of 3.07% and a negative net margin of 11.22%.The firm had revenue of $52.50 million during the quarter, compared to the consensus estimate of $54.59 million. Lakeland Industries has set its FY 2026 guidance at EPS. As a group, sell-side analysts forecast that Lakeland Industries will post 0.48 earnings per share for the current year.

Lakeland Industries Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, August 22nd. Stockholders of record on Friday, August 15th were given a $0.03 dividend. The ex-dividend date of this dividend was Friday, August 15th. This represents a $0.12 annualized dividend and a dividend yield of 0.8%. Lakeland Industries's dividend payout ratio is presently -4.38%.

Lakeland Industries Company Profile

(

Get Free Report)

Lakeland Industries, Inc manufactures and sells industrial protective clothing and accessories for the industrial and public protective clothing market worldwide. It offers firefighting and heat protective apparel to protect against fire; high-end chemical protective suits to provide protection from highly concentrated, toxic and/or lethal chemicals, and biological toxins; and limited use/disposable protective clothing, such as coveralls, laboratory coats, shirts, pants, hoods, aprons, sleeves, arm guards, caps, and smocks.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lakeland Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lakeland Industries wasn't on the list.

While Lakeland Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.