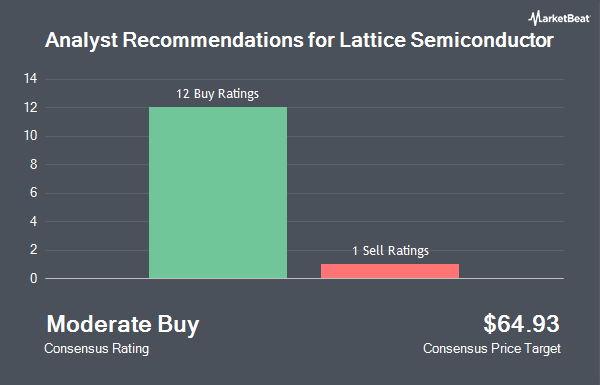

Lattice Semiconductor Corporation (NASDAQ:LSCC - Get Free Report) has earned an average recommendation of "Buy" from the eleven brokerages that are covering the company, MarketBeat reports. Eleven research analysts have rated the stock with a buy recommendation. The average 1-year target price among brokerages that have updated their coverage on the stock in the last year is $63.5833.

A number of equities research analysts have issued reports on the stock. Loop Capital cut their price target on shares of Lattice Semiconductor from $75.00 to $65.00 and set a "buy" rating on the stock in a report on Tuesday, August 5th. Williams Trading set a $60.00 price objective on shares of Lattice Semiconductor in a report on Tuesday, May 6th. Needham & Company LLC reaffirmed a "buy" rating and set a $70.00 target price on shares of Lattice Semiconductor in a report on Tuesday, May 6th. Robert W. Baird increased their price objective on shares of Lattice Semiconductor from $42.00 to $50.00 and gave the stock an "outperform" rating in a research note on Tuesday, May 6th. Finally, Raymond James Financial reaffirmed an "outperform" rating and set a $64.00 target price (down from $66.00) on shares of Lattice Semiconductor in a research note on Tuesday, May 6th.

Check Out Our Latest Analysis on LSCC

Lattice Semiconductor Price Performance

NASDAQ LSCC opened at $64.16 on Friday. Lattice Semiconductor has a 1 year low of $34.69 and a 1 year high of $70.55. The stock has a market capitalization of $8.78 billion, a PE ratio of 278.97, a P/E/G ratio of 4.52 and a beta of 1.52. The company's 50 day simple moving average is $54.43 and its two-hundred day simple moving average is $53.43.

Lattice Semiconductor (NASDAQ:LSCC - Get Free Report) last released its earnings results on Monday, August 4th. The semiconductor company reported $0.24 EPS for the quarter, meeting the consensus estimate of $0.24. Lattice Semiconductor had a net margin of 6.47% and a return on equity of 6.61%. The company had revenue of $123.97 million for the quarter, compared to analyst estimates of $123.60 million. During the same quarter last year, the firm earned $0.23 EPS. The firm's quarterly revenue was down .1% compared to the same quarter last year. Lattice Semiconductor has set its Q3 2025 guidance at 0.260-0.300 EPS. On average, research analysts anticipate that Lattice Semiconductor will post 0.65 EPS for the current year.

Insider Activity at Lattice Semiconductor

In related news, CAO Tonya Stevens sold 3,439 shares of Lattice Semiconductor stock in a transaction dated Wednesday, August 13th. The shares were sold at an average price of $64.92, for a total transaction of $223,259.88. Following the completion of the transaction, the chief accounting officer directly owned 87,776 shares of the company's stock, valued at approximately $5,698,417.92. The trade was a 3.77% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 1.80% of the company's stock.

Institutional Investors Weigh In On Lattice Semiconductor

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Price T Rowe Associates Inc. MD lifted its holdings in Lattice Semiconductor by 24.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,800,552 shares of the semiconductor company's stock valued at $409,139,000 after buying an additional 1,517,395 shares in the last quarter. State Street Corp raised its stake in shares of Lattice Semiconductor by 1.8% during the 2nd quarter. State Street Corp now owns 4,852,380 shares of the semiconductor company's stock worth $237,718,000 after acquiring an additional 85,973 shares in the last quarter. Bank of America Corp DE increased its stake in Lattice Semiconductor by 77.4% during the 2nd quarter. Bank of America Corp DE now owns 3,186,024 shares of the semiconductor company's stock valued at $156,083,000 after purchasing an additional 1,390,109 shares in the last quarter. Invesco Ltd. increased its stake in Lattice Semiconductor by 1.5% during the 2nd quarter. Invesco Ltd. now owns 2,191,134 shares of the semiconductor company's stock valued at $107,344,000 after purchasing an additional 33,042 shares in the last quarter. Finally, TD Asset Management Inc increased its stake in Lattice Semiconductor by 5.7% during the 2nd quarter. TD Asset Management Inc now owns 1,817,854 shares of the semiconductor company's stock valued at $89,057,000 after purchasing an additional 97,610 shares in the last quarter. Institutional investors own 98.08% of the company's stock.

Lattice Semiconductor Company Profile

(

Get Free Report)

Lattice Semiconductor Corporation, together with its subsidiaries, develops and sells semiconductor products in Asia, Europe, and the Americas. The company offers field programmable gate arrays that consist of four product families, including the Lattice Certus and ECP, Mach, iCE, and CrossLink. It also provides video connectivity application specific standard products.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lattice Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lattice Semiconductor wasn't on the list.

While Lattice Semiconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.