LB Pharmaceuticals (NASDAQ:LBRX - Get Free Report) was upgraded by research analysts at Zacks Research to a "hold" rating in a note issued to investors on Tuesday,Zacks.com reports.

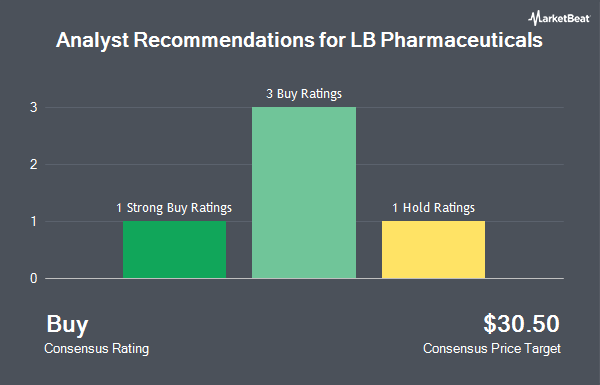

A number of other equities research analysts also recently issued reports on LBRX. Stifel Nicolaus assumed coverage on shares of LB Pharmaceuticals in a research report on Monday. They set a "buy" rating and a $27.00 price objective for the company. Leerink Partners initiated coverage on LB Pharmaceuticals in a research report on Monday. They issued an "outperform" rating and a $34.00 price target for the company. Leerink Partnrs raised LB Pharmaceuticals to a "strong-buy" rating in a research note on Monday. Piper Sandler initiated coverage on LB Pharmaceuticals in a research note on Monday. They set an "overweight" rating for the company. Finally, Wall Street Zen raised shares of LB Pharmaceuticals to a "hold" rating in a report on Monday, September 22nd. One research analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $30.50.

View Our Latest Report on LBRX

LB Pharmaceuticals Price Performance

LBRX opened at $15.04 on Tuesday. LB Pharmaceuticals has a 12-month low of $13.36 and a 12-month high of $20.25.

Insiders Place Their Bets

In related news, Director Ran Nussbaum purchased 1,000,000 shares of LB Pharmaceuticals stock in a transaction on Friday, September 12th. The shares were bought at an average cost of $15.00 per share, for a total transaction of $15,000,000.00. Following the acquisition, the director owned 1,411,681 shares in the company, valued at approximately $21,175,215. The trade was a 242.91% increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink.

About LB Pharmaceuticals

(

Get Free Report)

We are a clinical-stage biopharmaceutical company developing novel therapies for the treatment of schizophrenia, bipolar depression, and other neuropsychiatric diseases. We are building a pipeline that leverages the broad therapeutic potential of our lead product candidate, LB-102, which we believe has the potential to be the first benzamide antipsychotic drug approved for neuropsychiatric disorders in the United States.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider LB Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LB Pharmaceuticals wasn't on the list.

While LB Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.