LegalZoom.com (NASDAQ:LZ - Get Free Report) is anticipated to announce its Q2 2025 earnings results after the market closes on Thursday, August 7th. Analysts expect the company to announce earnings of $0.15 per share and revenue of $182.49 million for the quarter. LegalZoom.com has set its FY 2025 guidance at EPS and its Q2 2025 guidance at EPS.

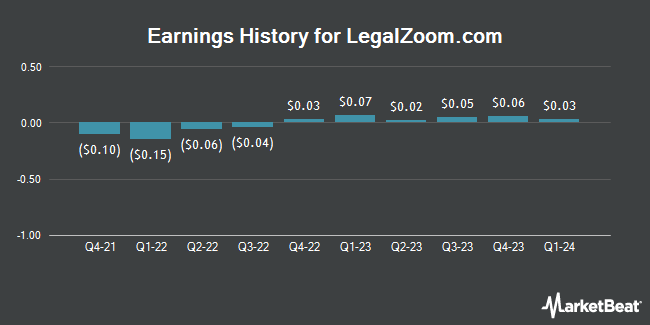

LegalZoom.com (NASDAQ:LZ - Get Free Report) last announced its quarterly earnings results on Wednesday, May 7th. The company reported $0.13 EPS for the quarter, meeting analysts' consensus estimates of $0.13. LegalZoom.com had a net margin of 4.39% and a return on equity of 28.00%. The business had revenue of $183.11 million for the quarter, compared to analyst estimates of $176.17 million. During the same quarter in the prior year, the business earned $0.09 EPS. LegalZoom.com's quarterly revenue was up 5.1% on a year-over-year basis. On average, analysts expect LegalZoom.com to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

LegalZoom.com Stock Performance

LZ traded down $0.32 on Friday, reaching $8.67. The company had a trading volume of 2,263,180 shares, compared to its average volume of 1,963,831. The company's fifty day moving average is $8.99 and its 200 day moving average is $8.74. LegalZoom.com has a fifty-two week low of $5.56 and a fifty-two week high of $10.60. The stock has a market cap of $1.57 billion, a P/E ratio of 51.00, a P/E/G ratio of 3.85 and a beta of 1.23.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on LZ. Wall Street Zen raised LegalZoom.com from a "buy" rating to a "strong-buy" rating in a report on Friday, May 30th. JMP Securities reissued a "market perform" rating on shares of LegalZoom.com in a report on Thursday, May 15th. JPMorgan Chase & Co. boosted their price target on LegalZoom.com from $11.00 to $12.00 and gave the stock an "overweight" rating in a report on Monday, May 19th. Finally, Morgan Stanley boosted their price target on LegalZoom.com from $7.00 to $8.00 and gave the stock an "underweight" rating in a report on Friday, May 9th. One analyst has rated the stock with a sell rating, five have given a hold rating, one has assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, LegalZoom.com presently has an average rating of "Hold" and an average target price of $9.30.

Get Our Latest Report on LegalZoom.com

Hedge Funds Weigh In On LegalZoom.com

Large investors have recently modified their holdings of the company. Brighton Jones LLC acquired a new position in LegalZoom.com during the 4th quarter valued at about $185,000. Amundi purchased a new stake in shares of LegalZoom.com in the first quarter worth approximately $196,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its stake in shares of LegalZoom.com by 3.0% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 74,980 shares of the company's stock worth $646,000 after purchasing an additional 2,161 shares during the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its stake in shares of LegalZoom.com by 1.7% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 275,978 shares of the company's stock worth $2,376,000 after purchasing an additional 4,607 shares during the last quarter. Finally, Goldman Sachs Group Inc. raised its stake in shares of LegalZoom.com by 9.5% in the first quarter. Goldman Sachs Group Inc. now owns 1,313,429 shares of the company's stock worth $11,309,000 after purchasing an additional 113,769 shares during the last quarter. 81.99% of the stock is currently owned by institutional investors.

About LegalZoom.com

(

Get Free Report)

LegalZoom.com, Inc, together with its subsidiaries, operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States. The company's platform offers business formation products, such as limited liability company, incorporation of C and S corporations, nonprofit formations, doing-business-as, corporate changes and filings, business licenses, legal forms, and beneficial ownership information reports; intellectual property products consisting of trademark and patent applications, and copyright registrations; and tax services, including business and personal tax preparations.

See Also

Before you consider LegalZoom.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LegalZoom.com wasn't on the list.

While LegalZoom.com currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.