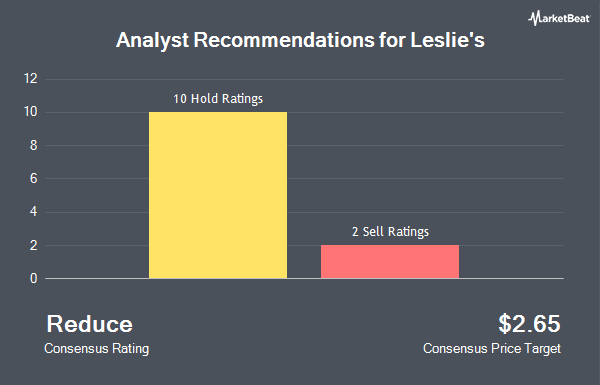

Shares of Leslie's, Inc. (NASDAQ:LESL - Get Free Report) have received an average rating of "Reduce" from the ten brokerages that are presently covering the stock, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell recommendation and nine have issued a hold recommendation on the company. The average 1 year price target among analysts that have updated their coverage on the stock in the last year is $1.60.

A number of research firms have weighed in on LESL. Mizuho dropped their price objective on shares of Leslie's from $3.00 to $1.00 and set a "neutral" rating on the stock in a research note on Thursday, July 3rd. Wall Street Zen raised shares of Leslie's to a "sell" rating in a research note on Saturday, July 26th. Finally, Telsey Advisory Group reaffirmed a "market perform" rating and issued a $0.35 price objective on shares of Leslie's in a research note on Friday, August 22nd.

Get Our Latest Analysis on LESL

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the company. Two Sigma Advisers LP bought a new position in shares of Leslie's during the fourth quarter valued at about $39,000. Wealth Enhancement Advisory Services LLC lifted its position in shares of Leslie's by 106.9% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 37,279 shares of the company's stock valued at $27,000 after purchasing an additional 19,257 shares in the last quarter. Performa Ltd US LLC increased its holdings in Leslie's by 785.7% during the first quarter. Performa Ltd US LLC now owns 46,500 shares of the company's stock worth $34,000 after buying an additional 41,250 shares during the last quarter. CWM LLC increased its holdings in Leslie's by 1,149.0% during the first quarter. CWM LLC now owns 46,914 shares of the company's stock worth $35,000 after buying an additional 43,158 shares during the last quarter. Finally, ProShare Advisors LLC increased its holdings in Leslie's by 44.4% during the fourth quarter. ProShare Advisors LLC now owns 54,268 shares of the company's stock worth $121,000 after buying an additional 16,674 shares during the last quarter.

Leslie's Trading Down 2.0%

Leslie's stock opened at $0.34 on Tuesday. Leslie's has a 1-year low of $0.27 and a 1-year high of $3.63. The firm has a market capitalization of $63.29 million, a price-to-earnings ratio of -0.76 and a beta of 1.27. The firm's fifty day moving average price is $0.39 and its two-hundred day moving average price is $0.61.

Leslie's Company Profile

(

Get Free Report)

Leslie's, Inc operates as a direct-to-consumer pool and spa care brand in the United States. The company markets and sells pool and spa supplies and related products and services. It also offers various pool and spa maintenance items, such as chemicals, equipment and parts, cleaning and maintenance equipment, safety, recreational, and fitness related products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Leslie's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leslie's wasn't on the list.

While Leslie's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.