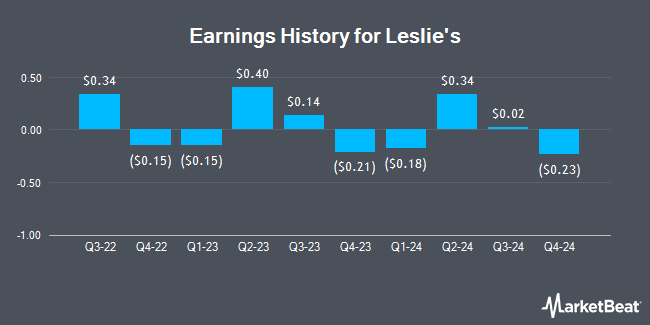

Leslie's (NASDAQ:LESL - Get Free Report) is expected to be posting its Q3 2025 quarterly earnings results after the market closes on Wednesday, August 6th. Analysts expect Leslie's to post earnings of $0.35 per share and revenue of $564.80 million for the quarter.

Leslie's Trading Up 2.4%

Shares of Leslie's stock traded up $0.01 during trading hours on Friday, reaching $0.38. 508,065 shares of the company's stock were exchanged, compared to its average volume of 5,099,989. The company has a 50 day moving average of $0.55 and a two-hundred day moving average of $0.93. Leslie's has a fifty-two week low of $0.35 and a fifty-two week high of $3.63. The stock has a market cap of $70.52 million, a P/E ratio of -1.57 and a beta of 1.28.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on LESL. Stifel Nicolaus upgraded shares of Leslie's from a "sell" rating to a "hold" rating in a research note on Friday, April 25th. Telsey Advisory Group cut their price objective on shares of Leslie's from $1.25 to $0.75 and set a "market perform" rating for the company in a research report on Tuesday. Mizuho cut their price objective on shares of Leslie's from $3.00 to $1.00 and set a "neutral" rating for the company in a research report on Thursday, July 3rd. Wall Street Zen upgraded shares of Leslie's to a "sell" rating in a research report on Saturday, July 26th. Finally, Loop Capital cut their price objective on shares of Leslie's from $4.00 to $1.00 and set a "hold" rating for the company in a research report on Friday, May 9th. Two analysts have rated the stock with a sell rating and nine have given a hold rating to the company. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $1.65.

Get Our Latest Stock Analysis on Leslie's

Institutional Inflows and Outflows

A hedge fund recently raised its stake in Leslie's stock. Jane Street Group LLC boosted its position in Leslie's, Inc. (NASDAQ:LESL - Free Report) by 123.7% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 2,213,776 shares of the company's stock after acquiring an additional 1,224,115 shares during the quarter. Jane Street Group LLC owned 1.19% of Leslie's worth $1,628,000 at the end of the most recent reporting period.

About Leslie's

(

Get Free Report)

Leslie's, Inc operates as a direct-to-consumer pool and spa care brand in the United States. The company markets and sells pool and spa supplies and related products and services. It also offers various pool and spa maintenance items, such as chemicals, equipment and parts, cleaning and maintenance equipment, safety, recreational, and fitness related products.

Read More

Before you consider Leslie's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leslie's wasn't on the list.

While Leslie's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.