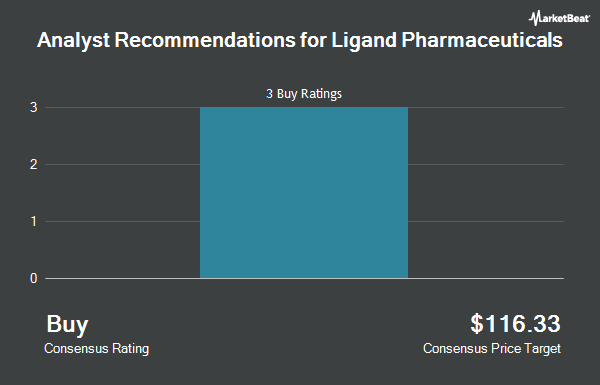

Ligand Pharmaceuticals Incorporated (NASDAQ:LGND - Get Free Report) has earned an average recommendation of "Buy" from the six research firms that are currently covering the firm, Marketbeat reports. Six equities research analysts have rated the stock with a buy recommendation. The average 12-month price target among brokers that have updated their coverage on the stock in the last year is $165.1667.

A number of brokerages recently commented on LGND. Wall Street Zen raised shares of Ligand Pharmaceuticals from a "hold" rating to a "buy" rating in a research report on Saturday, August 9th. HC Wainwright boosted their price objective on shares of Ligand Pharmaceuticals from $157.00 to $206.00 and gave the company a "buy" rating in a research report on Thursday. Royal Bank Of Canada boosted their price objective on shares of Ligand Pharmaceuticals from $155.00 to $185.00 and gave the company an "outperform" rating in a research report on Friday, August 8th. Finally, Oppenheimer boosted their price objective on shares of Ligand Pharmaceuticals from $145.00 to $162.00 and gave the company an "outperform" rating in a research report on Wednesday, July 30th.

Get Our Latest Report on Ligand Pharmaceuticals

Insider Buying and Selling

In other news, insider Andrew Reardon sold 500 shares of the stock in a transaction on Monday, June 23rd. The shares were sold at an average price of $114.08, for a total transaction of $57,040.00. Following the transaction, the insider owned 31,903 shares in the company, valued at $3,639,494.24. This represents a 1.54% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director John W. Kozarich sold 934 shares of the stock in a transaction on Thursday, July 10th. The stock was sold at an average price of $125.00, for a total transaction of $116,750.00. Following the transaction, the director owned 46,456 shares in the company, valued at approximately $5,807,000. This trade represents a 1.97% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 2,401 shares of company stock worth $292,648 over the last ninety days. 7.00% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the business. Maseco LLP acquired a new position in shares of Ligand Pharmaceuticals during the 2nd quarter worth $31,000. Opal Wealth Advisors LLC acquired a new position in shares of Ligand Pharmaceuticals during the 1st quarter worth $32,000. GF Fund Management CO. LTD. acquired a new position in shares of Ligand Pharmaceuticals during the 4th quarter worth $43,000. Simplex Trading LLC acquired a new position in shares of Ligand Pharmaceuticals during the 2nd quarter worth $61,000. Finally, GAMMA Investing LLC increased its stake in shares of Ligand Pharmaceuticals by 68.5% during the 1st quarter. GAMMA Investing LLC now owns 593 shares of the biotechnology company's stock worth $62,000 after purchasing an additional 241 shares during the last quarter. Institutional investors and hedge funds own 91.28% of the company's stock.

Ligand Pharmaceuticals Stock Up 1.1%

Shares of LGND stock traded up $1.75 during trading hours on Friday, reaching $161.71. 147,031 shares of the stock traded hands, compared to its average volume of 310,350. Ligand Pharmaceuticals has a 1-year low of $93.58 and a 1-year high of $163.34. The business has a fifty day moving average price of $135.91 and a 200 day moving average price of $117.89. The firm has a market capitalization of $3.17 billion, a PE ratio of -40.43 and a beta of 0.85.

Ligand Pharmaceuticals (NASDAQ:LGND - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The biotechnology company reported $1.60 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.54 by $0.06. Ligand Pharmaceuticals had a negative net margin of 40.44% and a negative return on equity of 9.21%. The business had revenue of $47.63 million for the quarter, compared to analyst estimates of $43.87 million. During the same quarter in the previous year, the business earned $1.40 earnings per share. The firm's revenue was up 14.7% compared to the same quarter last year. Ligand Pharmaceuticals has set its FY 2025 guidance at 6.700-7.000 EPS. Research analysts expect that Ligand Pharmaceuticals will post 1.73 earnings per share for the current fiscal year.

Ligand Pharmaceuticals Company Profile

(

Get Free Report)

Ligand Pharmaceuticals Incorporated, a biopharmaceutical company, engages in the development and licensing of biopharmaceutical assets worldwide. Its commercial programs include Kyprolis and Evomela, which are used to treat multiple myeloma; Rylaze, a recombinant erwinia asparaginase for the treatment of acute lymphoblastic leukemia or lymphoblastic lymphoma in adult and pediatric patients; Filspari, a dual endothelin and angiotensin II receptor antagonist in development for rare kidney diseases and non-immunosuppressive treatment indicated for immunoglobulin A nephropathy; Teriparatide injection product for osteoporosis; Vaxneuvance for the prevention of invasive disease caused by streptococcus pneumoniae serotypes; and Pneumosil, a pneumococcal conjugate vaccine to help fight against pneumococcal pneumonia among children.

Further Reading

Before you consider Ligand Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ligand Pharmaceuticals wasn't on the list.

While Ligand Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.