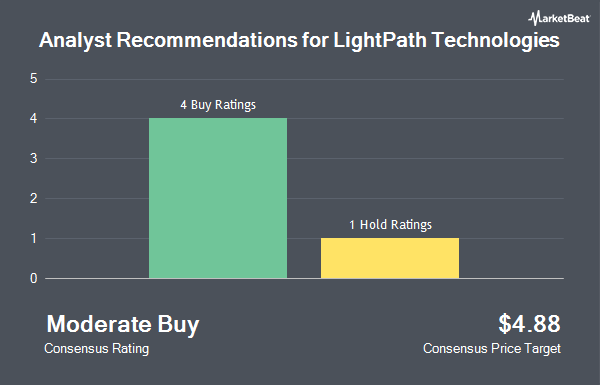

LightPath Technologies, Inc. (NASDAQ:LPTH - Get Free Report) has received an average recommendation of "Moderate Buy" from the five analysts that are currently covering the stock, MarketBeat.com reports. One equities research analyst has rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is $4.8750.

Several equities research analysts have recently weighed in on LPTH shares. HC Wainwright reaffirmed a "buy" rating and issued a $5.00 target price on shares of LightPath Technologies in a research report on Monday, May 19th. Wall Street Zen raised LightPath Technologies from a "sell" rating to a "hold" rating in a research report on Saturday, June 14th. Zacks Research raised LightPath Technologies to a "hold" rating in a research report on Tuesday, August 12th. Finally, Craig Hallum started coverage on LightPath Technologies in a research report on Monday, April 28th. They issued a "buy" rating and a $5.50 target price for the company.

View Our Latest Report on LPTH

LightPath Technologies Stock Down 3.8%

Shares of NASDAQ LPTH traded down $0.1350 on Friday, hitting $3.4550. The company had a trading volume of 116,418 shares, compared to its average volume of 231,995. LightPath Technologies has a 12-month low of $1.04 and a 12-month high of $4.42. The business has a 50 day moving average of $3.22 and a two-hundred day moving average of $2.67. The company has a quick ratio of 1.26, a current ratio of 2.30 and a debt-to-equity ratio of 0.33. The firm has a market capitalization of $153.57 million, a P/E ratio of -13.29 and a beta of 0.82.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of LPTH. Geode Capital Management LLC boosted its holdings in LightPath Technologies by 15.0% in the fourth quarter. Geode Capital Management LLC now owns 389,619 shares of the technology company's stock valued at $1,376,000 after purchasing an additional 50,767 shares during the last quarter. EAM Investors LLC purchased a new position in LightPath Technologies in the fourth quarter valued at about $1,102,000. Price T Rowe Associates Inc. MD boosted its holdings in LightPath Technologies by 101.3% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 30,800 shares of the technology company's stock valued at $109,000 after purchasing an additional 15,500 shares during the last quarter. Northern Trust Corp boosted its holdings in LightPath Technologies by 25.7% in the fourth quarter. Northern Trust Corp now owns 63,983 shares of the technology company's stock valued at $226,000 after purchasing an additional 13,087 shares during the last quarter. Finally, Jane Street Group LLC purchased a new position in LightPath Technologies in the fourth quarter valued at about $111,000. Hedge funds and other institutional investors own 56.29% of the company's stock.

About LightPath Technologies

(

Get Free Report)

LightPath Technologies, Inc designs, develops, manufactures, and distributes optical components and assemblies. The company offers precision molded glass aspheric optics, molded and diamond-turned infrared aspheric lenses, and other optical components used to produce products that manipulate light; and infrared products, including catalog and custom infrared optics.

Recommended Stories

Before you consider LightPath Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LightPath Technologies wasn't on the list.

While LightPath Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.