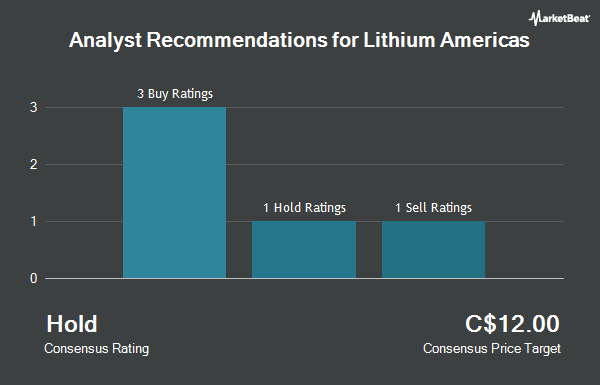

Shares of Lithium Americas Corp. (TSE:LAC - Get Free Report) have been assigned a consensus rating of "Hold" from the nine analysts that are presently covering the stock, Marketbeat.com reports. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and one has assigned a strong buy rating to the company. The average 12 month target price among brokers that have covered the stock in the last year is C$8.13.

LAC has been the subject of a number of research reports. National Bankshares upped their target price on shares of Lithium Americas from C$5.00 to C$10.00 and gave the stock a "sector perform" rating in a research report on Thursday, October 2nd. Scotiabank lowered shares of Lithium Americas from a "hold" rating to a "strong sell" rating in a research report on Monday, October 6th. TD Cowen lowered shares of Lithium Americas from a "strong-buy" rating to a "hold" rating in a research report on Thursday, September 25th. Canaccord Genuity Group lowered shares of Lithium Americas from a "moderate buy" rating to a "sell" rating and set a C$6.25 target price for the company. in a research report on Thursday, October 2nd. Finally, Cormark lowered shares of Lithium Americas from a "moderate buy" rating to a "hold" rating in a research report on Thursday, October 2nd.

Check Out Our Latest Research Report on LAC

Lithium Americas Price Performance

Shares of TSE:LAC opened at C$9.53 on Monday. The company has a debt-to-equity ratio of 0.65, a quick ratio of 52.06 and a current ratio of 13.88. The firm has a fifty day moving average price of C$6.40 and a 200 day moving average price of C$4.73. Lithium Americas has a fifty-two week low of C$3.30 and a fifty-two week high of C$14.75. The firm has a market cap of C$2.36 billion, a price-to-earnings ratio of -38.12 and a beta of 1.26.

Lithium Americas Company Profile

(

Get Free Report)

Lithium Americas is developing three lithium production assets, two brine resources located in northwestern Argentina and a clay resource in Nevada, U.S. While the company has no current lithium production, we expect the first Argentina resource, Cauchari-Olaroz, to enter production in late 2022. We expect the Nevada project, Thacker Pass, to enter production in the middle of the 2020s and the second brine resource, Pastos Grandes, to enter production in the late-2020s.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.