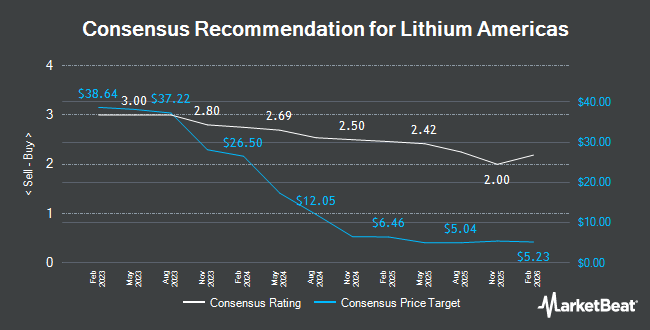

Lithium Americas (NYSE:LAC - Get Free Report)'s stock had its "sector underperform" rating reiterated by equities research analysts at Scotiabank in a report released on Monday, Marketbeat.com reports. They presently have a $5.00 price objective on the stock, up from their prior price objective of $2.75. Scotiabank's target price indicates a potential downside of 40.97% from the company's current price.

Other equities analysts have also issued reports about the company. TD Cowen restated a "hold" rating and set a $5.00 price target on shares of Lithium Americas in a research report on Thursday, September 25th. TD Securities lowered Lithium Americas from a "buy" rating to a "hold" rating and set a $5.00 price target on the stock. in a research report on Thursday, September 25th. Canaccord Genuity Group lowered Lithium Americas from a "speculative buy" rating to a "sell" rating in a research report on Thursday, October 2nd. Weiss Ratings restated a "sell (e+)" rating on shares of Lithium Americas in a research report on Saturday, September 27th. Finally, Jefferies Financial Group reduced their price target on Lithium Americas from $8.00 to $7.00 and set a "buy" rating on the stock in a research report on Wednesday, September 24th. Three investment analysts have rated the stock with a Buy rating, nine have issued a Hold rating and three have issued a Sell rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $5.33.

View Our Latest Analysis on LAC

Lithium Americas Stock Performance

Lithium Americas stock opened at $8.47 on Monday. The firm has a fifty day simple moving average of $3.62 and a two-hundred day simple moving average of $3.09. The company has a quick ratio of 9.88, a current ratio of 9.88 and a debt-to-equity ratio of 0.33. Lithium Americas has a twelve month low of $2.31 and a twelve month high of $9.48. The company has a market capitalization of $2.05 billion, a PE ratio of -36.82 and a beta of 1.43.

Lithium Americas (NYSE:LAC - Get Free Report) last released its earnings results on Thursday, August 14th. The company reported ($0.06) earnings per share for the quarter, missing analysts' consensus estimates of ($0.04) by ($0.02). Research analysts expect that Lithium Americas will post -0.12 EPS for the current year.

Insider Buying and Selling at Lithium Americas

In other news, VP Alexi Illya Zawadzki sold 353,914 shares of Lithium Americas stock in a transaction that occurred on Wednesday, October 1st. The stock was sold at an average price of $9.48, for a total value of $3,355,104.72. Following the sale, the vice president directly owned 40,005 shares in the company, valued at approximately $379,247.40. This trade represents a 89.84% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 1.11% of the company's stock.

Institutional Investors Weigh In On Lithium Americas

A number of large investors have recently made changes to their positions in the business. Axxcess Wealth Management LLC boosted its position in shares of Lithium Americas by 33.9% during the second quarter. Axxcess Wealth Management LLC now owns 16,582 shares of the company's stock valued at $44,000 after purchasing an additional 4,200 shares in the last quarter. HITE Hedge Asset Management LLC boosted its position in shares of Lithium Americas by 0.6% during the first quarter. HITE Hedge Asset Management LLC now owns 735,918 shares of the company's stock valued at $1,994,000 after purchasing an additional 4,445 shares in the last quarter. Harbour Investments Inc. boosted its position in shares of Lithium Americas by 86.1% during the second quarter. Harbour Investments Inc. now owns 9,900 shares of the company's stock valued at $27,000 after purchasing an additional 4,580 shares in the last quarter. Creative Planning boosted its position in shares of Lithium Americas by 18.4% during the second quarter. Creative Planning now owns 48,936 shares of the company's stock valued at $131,000 after purchasing an additional 7,610 shares in the last quarter. Finally, Mackenzie Financial Corp boosted its position in shares of Lithium Americas by 8.7% during the first quarter. Mackenzie Financial Corp now owns 95,359 shares of the company's stock valued at $258,000 after purchasing an additional 7,658 shares in the last quarter.

Lithium Americas Company Profile

(

Get Free Report)

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada. Lithium Americas Corp.

Recommended Stories

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.