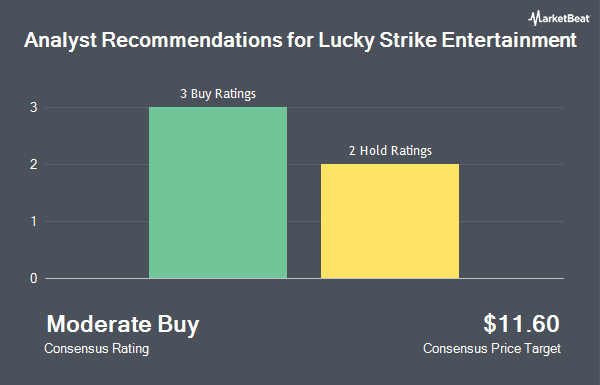

Lucky Strike Entertainment (NYSE:LUCK - Get Free Report) has earned a consensus rating of "Hold" from the six research firms that are presently covering the company, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, two have given a hold recommendation and three have assigned a buy recommendation to the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is $11.60.

Several equities analysts have recently weighed in on the company. Stifel Nicolaus lowered their price target on Lucky Strike Entertainment from $13.00 to $12.00 and set a "buy" rating on the stock in a report on Friday, June 20th. Zacks Research raised Lucky Strike Entertainment to a "strong sell" rating in a report on Tuesday, August 12th. Canaccord Genuity Group reissued a "buy" rating and set a $16.00 price target (down from $18.00) on shares of Lucky Strike Entertainment in a report on Monday, May 5th. Finally, Roth Capital cut Lucky Strike Entertainment from a "buy" rating to a "neutral" rating and set a $9.00 price target on the stock. in a report on Monday, May 12th.

Check Out Our Latest Research Report on LUCK

Insider Transactions at Lucky Strike Entertainment

In other news, CEO Thomas F. Shannon acquired 20,000 shares of the business's stock in a transaction dated Wednesday, May 28th. The stock was purchased at an average price of $8.73 per share, for a total transaction of $174,600.00. Following the completion of the transaction, the chief executive officer directly owned 2,364,000 shares in the company, valued at approximately $20,637,720. This trade represents a 0.85% increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. In the last ninety days, insiders acquired 22,350 shares of company stock valued at $194,778. Corporate insiders own 79.90% of the company's stock.

Institutional Trading of Lucky Strike Entertainment

Institutional investors have recently added to or reduced their stakes in the company. Farther Finance Advisors LLC bought a new stake in shares of Lucky Strike Entertainment during the second quarter valued at approximately $30,000. Spire Wealth Management bought a new stake in shares of Lucky Strike Entertainment during the second quarter valued at approximately $42,000. PNC Financial Services Group Inc. bought a new stake in shares of Lucky Strike Entertainment during the second quarter valued at approximately $50,000. Bank of America Corp DE bought a new stake in shares of Lucky Strike Entertainment during the second quarter valued at approximately $94,000. Finally, Invesco Ltd. bought a new stake in shares of Lucky Strike Entertainment during the second quarter valued at approximately $114,000. Institutional investors own 68.11% of the company's stock.

Lucky Strike Entertainment Stock Performance

Shares of Lucky Strike Entertainment stock traded down $0.13 during midday trading on Friday, hitting $10.08. The company had a trading volume of 25,151 shares, compared to its average volume of 356,292. The stock has a market capitalization of $1.41 billion, a P/E ratio of -143.98 and a beta of 0.75. The company has a 50 day moving average of $9.82 and a 200 day moving average of $9.71. Lucky Strike Entertainment has a 52-week low of $7.66 and a 52-week high of $13.25.

Lucky Strike Entertainment Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, September 12th. Shareholders of record on Friday, August 29th will be paid a $0.055 dividend. This represents a $0.22 dividend on an annualized basis and a yield of 2.2%. Lucky Strike Entertainment's payout ratio is presently -314.29%.

About Lucky Strike Entertainment

(

Get Free Report)

Lucky Strike Entertainment Corp. engages in operating bowling centers. It offers entertainment concepts with lounge seating, arcades, food and beverage offerings, and hosting and overseeing professional and non-professional bowling tournaments and related broadcasting. The company was founded by Thomas F.

Featured Articles

Before you consider Lucky Strike Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucky Strike Entertainment wasn't on the list.

While Lucky Strike Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.