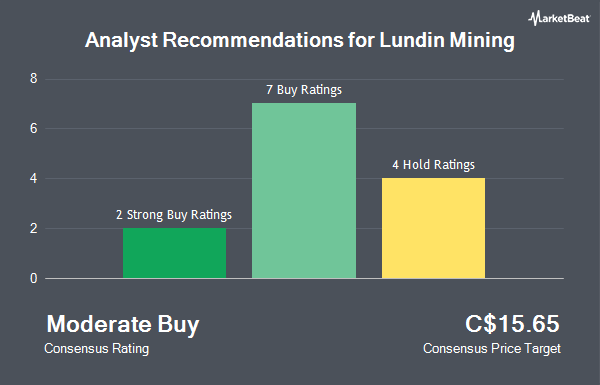

Shares of Lundin Mining Co. (TSE:LUN - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the fourteen research firms that are currently covering the firm, MarketBeat.com reports. Five equities research analysts have rated the stock with a hold rating, six have issued a buy rating and three have assigned a strong buy rating to the company. The average 1-year price objective among analysts that have covered the stock in the last year is C$18.90.

LUN has been the subject of a number of recent analyst reports. Desjardins set a C$17.00 target price on Lundin Mining and gave the company a "buy" rating in a report on Thursday, June 19th. JPMorgan Chase & Co. lowered shares of Lundin Mining from an "overweight" rating to a "neutral" rating and upped their target price for the stock from C$15.30 to C$15.60 in a research report on Thursday, July 10th. Dnb Nor Markets upgraded shares of Lundin Mining to a "hold" rating in a research report on Tuesday, June 17th. Raymond James Financial increased their price target on shares of Lundin Mining from C$43.00 to C$53.00 in a research report on Tuesday, July 29th. Finally, National Bankshares boosted their target price on shares of Lundin Mining from C$16.50 to C$17.50 and gave the company an "outperform" rating in a research note on Wednesday, July 9th.

Check Out Our Latest Stock Analysis on LUN

Lundin Mining Stock Performance

LUN traded down C$0.31 on Friday, reaching C$15.61. The company had a trading volume of 198,582 shares, compared to its average volume of 2,576,312. The company has a quick ratio of 0.90, a current ratio of 1.40 and a debt-to-equity ratio of 41.58. The stock has a market capitalization of C$9.54 billion, a PE ratio of 30.98, a P/E/G ratio of -0.26 and a beta of 1.66. Lundin Mining has a 1 year low of C$8.94 and a 1 year high of C$15.99. The stock has a 50-day moving average price of C$14.15 and a 200-day moving average price of C$12.68.

Insiders Place Their Bets

In other Lundin Mining news, insider Nemesia S.a.r.l. bought 900,000 shares of the business's stock in a transaction dated Friday, June 13th. The shares were acquired at an average price of C$14.10 per share, with a total value of C$12,690,000.00. Also, Director Jack Oliver Lundin purchased 20,000 shares of the company's stock in a transaction that occurred on Thursday, May 22nd. The shares were purchased at an average cost of C$12.65 per share, for a total transaction of C$252,934.00. 15.70% of the stock is owned by company insiders.

About Lundin Mining

(

Get Free Report)

Lundin Mining Corp is a diversified Canadian base metals mining company with operations in Brazil Chile Portugal Sweden and the United States of America producing copper zinc gold and nickel. Its material mineral properties include Candelaria Chapada Eagle and Neves-Corvo.

Further Reading

Before you consider Lundin Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Mining wasn't on the list.

While Lundin Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.