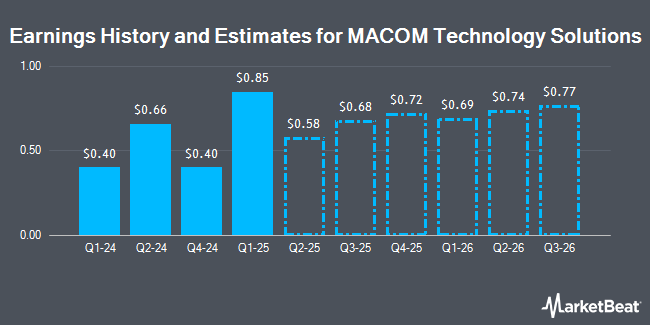

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) issued an update on its fourth quarter 2025 earnings guidance on Thursday morning. The company provided earnings per share guidance of 0.910-0.950 for the period, compared to the consensus earnings per share estimate of 0.930. The company issued revenue guidance of $256.0 million-$264.0 million, compared to the consensus revenue estimate of $254.0 million.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on the company. Barclays upped their price target on MACOM Technology Solutions from $125.00 to $150.00 and gave the stock an "overweight" rating in a report on Friday, May 9th. Benchmark reaffirmed a "buy" rating and issued a $160.00 price target on shares of MACOM Technology Solutions in a report on Friday, May 9th. Stifel Nicolaus boosted their target price on shares of MACOM Technology Solutions from $140.00 to $155.00 and gave the stock a "buy" rating in a research report on Friday, July 18th. Wall Street Zen raised shares of MACOM Technology Solutions from a "hold" rating to a "buy" rating in a research note on Sunday, July 20th. Finally, Truist Financial increased their target price on shares of MACOM Technology Solutions from $136.00 to $154.00 and gave the stock a "buy" rating in a report on Monday, July 7th. One analyst has rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, MACOM Technology Solutions currently has an average rating of "Buy" and a consensus target price of $146.13.

Read Our Latest Analysis on MTSI

MACOM Technology Solutions Stock Performance

Shares of MTSI stock traded down $0.46 during trading hours on Monday, reaching $120.49. The company had a trading volume of 53,188 shares, compared to its average volume of 758,430. The firm has a market cap of $8.97 billion, a PE ratio of -119.29, a price-to-earnings-growth ratio of 2.28 and a beta of 1.38. The business has a fifty day moving average price of $135.64 and a 200-day moving average price of $120.71. MACOM Technology Solutions has a one year low of $84.00 and a one year high of $152.50. The company has a debt-to-equity ratio of 0.32, a quick ratio of 3.10 and a current ratio of 3.83.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The semiconductor company reported $0.90 EPS for the quarter, topping the consensus estimate of $0.89 by $0.01. MACOM Technology Solutions had a positive return on equity of 14.02% and a negative net margin of 7.71%. The business had revenue of $252.08 million for the quarter, compared to analyst estimates of $249.89 million. During the same quarter in the prior year, the firm posted $0.66 EPS. The business's quarterly revenue was up 32.3% compared to the same quarter last year. Sell-side analysts predict that MACOM Technology Solutions will post 2.43 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, Director Susan Ocampo sold 104,449 shares of the firm's stock in a transaction dated Wednesday, May 21st. The stock was sold at an average price of $123.98, for a total transaction of $12,949,587.02. Following the sale, the director directly owned 4,118,621 shares in the company, valued at approximately $510,626,631.58. This trade represents a 2.47% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, SVP Robert Dennehy sold 5,000 shares of MACOM Technology Solutions stock in a transaction that occurred on Tuesday, June 24th. The stock was sold at an average price of $140.42, for a total value of $702,100.00. Following the completion of the transaction, the senior vice president owned 15,680 shares of the company's stock, valued at approximately $2,201,785.60. The trade was a 24.18% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 147,812 shares of company stock valued at $18,497,908 in the last 90 days. Company insiders own 16.30% of the company's stock.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the business. Advisors Asset Management Inc. lifted its holdings in MACOM Technology Solutions by 49.7% during the first quarter. Advisors Asset Management Inc. now owns 485 shares of the semiconductor company's stock worth $49,000 after acquiring an additional 161 shares in the last quarter. Cetera Investment Advisers bought a new position in shares of MACOM Technology Solutions in the 2nd quarter valued at $372,000. Focus Partners Wealth increased its holdings in MACOM Technology Solutions by 121.3% in the first quarter. Focus Partners Wealth now owns 6,739 shares of the semiconductor company's stock valued at $676,000 after purchasing an additional 3,694 shares during the period. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its holdings in MACOM Technology Solutions by 9.2% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 157,182 shares of the semiconductor company's stock worth $15,778,000 after acquiring an additional 13,215 shares during the period. 76.14% of the stock is owned by institutional investors and hedge funds.

MACOM Technology Solutions Company Profile

(

Get Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Recommended Stories

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.