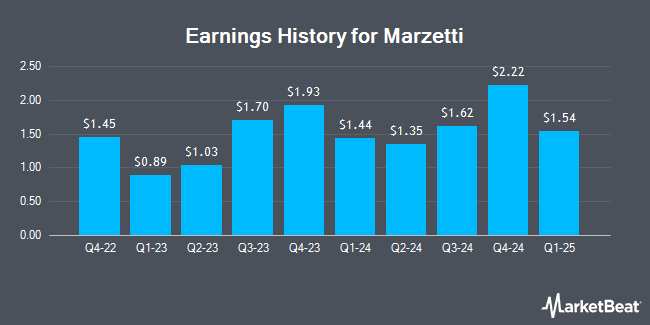

Marzetti (NASDAQ:MZTI - Get Free Report) is projected to issue its Q4 2025 quarterly earnings data before the market opens on Thursday, August 21st. Analysts expect the company to announce earnings of $1.31 per share and revenue of $455.26 million for the quarter.

Marzetti Stock Up 0.0%

Shares of NASDAQ MZTI traded up $0.06 during midday trading on Monday, hitting $180.35. The stock had a trading volume of 16,009 shares, compared to its average volume of 160,992. The company has a market capitalization of $4.97 billion, a price-to-earnings ratio of 29.33 and a beta of 0.47. Marzetti has a 1-year low of $156.14 and a 1-year high of $202.63. The company has a fifty day moving average price of $172.95 and a 200 day moving average price of $176.71.

Marzetti Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Monday, September 8th will be given a $0.95 dividend. The ex-dividend date of this dividend is Monday, September 8th. This represents a $3.80 annualized dividend and a yield of 2.1%. Marzetti's dividend payout ratio (DPR) is 61.79%.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the business. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its position in shares of Marzetti by 4.5% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 11,637 shares of the company's stock valued at $2,036,000 after purchasing an additional 500 shares during the period. Strs Ohio acquired a new stake in shares of Marzetti during the 1st quarter valued at about $175,000. Royal Bank of Canada lifted its holdings in shares of Marzetti by 3.8% during the 1st quarter. Royal Bank of Canada now owns 32,626 shares of the company's stock valued at $5,710,000 after buying an additional 1,186 shares during the last quarter. United Services Automobile Association bought a new position in shares of Marzetti in the 1st quarter valued at approximately $231,000. Finally, Empowered Funds LLC bought a new position in shares of Marzetti in the 1st quarter valued at approximately $2,310,000. 66.44% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts have issued reports on the stock. Benchmark raised shares of Marzetti from a "hold" rating to a "buy" rating and set a $185.00 price objective for the company in a research report on Thursday, May 1st. Wall Street Zen cut Marzetti from a "buy" rating to a "hold" rating in a research note on Monday, May 5th. Finally, Stephens lowered their price objective on Marzetti from $200.00 to $195.00 and set an "equal weight" rating for the company in a research note on Thursday, May 1st. Three equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $203.50.

Get Our Latest Analysis on MZTI

About Marzetti

(

Get Free Report)

Lancaster Colony Corporation engages in the manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States. It operates in two segments, Retail and Foodservice. The company offers frozen garlic bread under the New York BRAND Bakery; frozen Parkerhouse style yeast and dinner rolls under the Sister Schubert's brand; salad dressings under the Marzetti, Simply Dressed, Cardini's, and Girard's brands; vegetable and fruit dips under the Marzetti brand; croutons and salad toppings under the New York BRAND Bakery, Chatham Village, and Marzetti brands; and frozen pasta under the Marzetti Frozen Pasta brand.

Read More

Before you consider Marzetti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marzetti wasn't on the list.

While Marzetti currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.