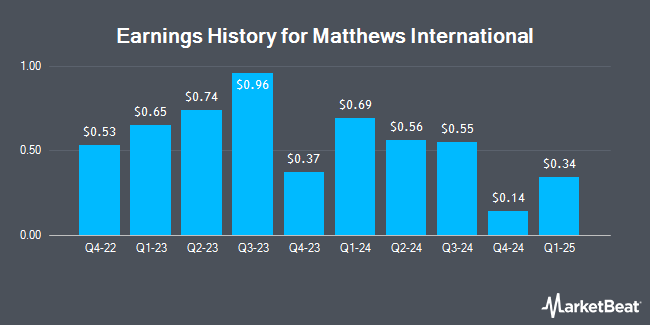

Matthews International (NASDAQ:MATW - Get Free Report) released its quarterly earnings data on Tuesday. The company reported $0.28 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.33 by ($0.05), Zacks reports. The firm had revenue of $349.40 million for the quarter, compared to the consensus estimate of $321.95 million. Matthews International had a negative net margin of 4.01% and a positive return on equity of 9.15%.

Matthews International Price Performance

Shares of MATW traded down $0.15 during trading hours on Friday, hitting $23.58. The stock had a trading volume of 241,721 shares, compared to its average volume of 203,033. The stock has a market capitalization of $726.03 million, a price-to-earnings ratio of -11.12 and a beta of 1.24. The company has a debt-to-equity ratio of 1.35, a current ratio of 1.66 and a quick ratio of 1.09. The company's fifty day moving average is $23.61 and its two-hundred day moving average is $23.12. Matthews International has a 52 week low of $18.50 and a 52 week high of $32.24.

Matthews International Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, August 25th. Stockholders of record on Monday, August 11th will be issued a $0.25 dividend. The ex-dividend date of this dividend is Monday, August 11th. This represents a $1.00 annualized dividend and a dividend yield of 4.2%. Matthews International's dividend payout ratio is presently -47.17%.

Institutional Investors Weigh In On Matthews International

Hedge funds and other institutional investors have recently bought and sold shares of the business. Intech Investment Management LLC grew its holdings in shares of Matthews International by 316.4% during the first quarter. Intech Investment Management LLC now owns 59,502 shares of the company's stock worth $1,323,000 after purchasing an additional 45,212 shares during the last quarter. Jane Street Group LLC acquired a new position in Matthews International during the 1st quarter worth about $1,227,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in Matthews International by 4.6% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 17,686 shares of the company's stock worth $393,000 after acquiring an additional 780 shares during the last quarter. 83.08% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen raised Matthews International from a "sell" rating to a "hold" rating in a report on Saturday.

Get Our Latest Stock Analysis on Matthews International

About Matthews International

(

Get Free Report)

Matthews International Corporation provides brand solutions, memorialization products, and industrial technologies worldwide. It operates through three segments: Memorialization, Industrial Technologies, and SGK Brand Solutions. The Memorialization segment provides bronze and granite memorials, upright granite memorials and monuments, concrete burial vaults, cremation memorialization products, granite benches, flower vases, crypt plates and letters, cremation urns, niche units, cemetery features, and statues, as well as bronze plaques, letters, emblems, vases, lights and photo ceramics, granite monuments, mausoleums, crypts, and flush memorials.

Recommended Stories

Before you consider Matthews International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Matthews International wasn't on the list.

While Matthews International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.