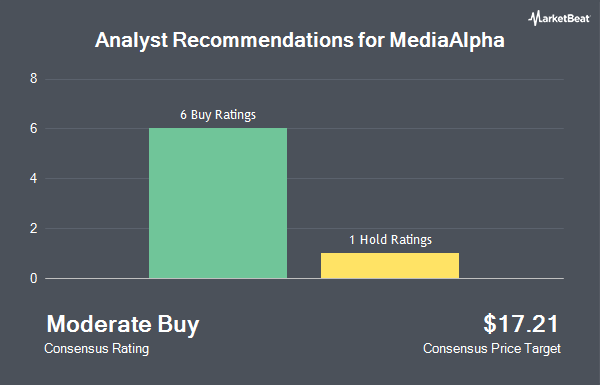

MediaAlpha, Inc. (NYSE:MAX - Get Free Report) has been assigned a consensus rating of "Buy" from the six analysts that are covering the stock, Marketbeat.com reports. Six analysts have rated the stock with a buy recommendation. The average 12 month target price among brokers that have covered the stock in the last year is $17.9167.

A number of equities analysts have issued reports on the stock. Royal Bank Of Canada cut their target price on shares of MediaAlpha from $20.00 to $18.00 and set an "outperform" rating on the stock in a report on Wednesday, May 7th. Keefe, Bruyette & Woods reduced their price target on shares of MediaAlpha from $19.00 to $16.00 and set an "outperform" rating for the company in a report on Tuesday, April 22nd. The Goldman Sachs Group cut their price objective on shares of MediaAlpha from $14.00 to $12.50 and set a "buy" rating on the stock in a research report on Monday, April 14th. Finally, JPMorgan Chase & Co. raised their target price on MediaAlpha from $10.00 to $12.00 and gave the company an "overweight" rating in a research report on Thursday, May 1st.

View Our Latest Report on MediaAlpha

Institutional Trading of MediaAlpha

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Allspring Global Investments Holdings LLC boosted its stake in MediaAlpha by 54.2% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 42,298 shares of the company's stock worth $381,000 after purchasing an additional 14,871 shares during the period. GAMMA Investing LLC boosted its holdings in MediaAlpha by 8,775.8% in the first quarter. GAMMA Investing LLC now owns 2,929 shares of the company's stock worth $27,000 after purchasing an additional 2,896 shares in the last quarter. Vanguard Group Inc. raised its position in shares of MediaAlpha by 4.9% in the fourth quarter. Vanguard Group Inc. now owns 3,623,344 shares of the company's stock valued at $40,908,000 after purchasing an additional 169,654 shares during the period. Virtus Investment Advisers Inc. acquired a new position in shares of MediaAlpha during the 4th quarter worth about $172,000. Finally, Millennium Management LLC boosted its holdings in MediaAlpha by 91.0% in the 4th quarter. Millennium Management LLC now owns 781,349 shares of the company's stock valued at $8,821,000 after purchasing an additional 372,305 shares during the period. 64.39% of the stock is currently owned by institutional investors.

MediaAlpha Stock Performance

MediaAlpha stock traded up $0.92 during trading on Monday, hitting $11.27. The company's stock had a trading volume of 677,587 shares, compared to its average volume of 491,054. The stock's fifty day moving average is $10.56 and its 200 day moving average is $10.10. MediaAlpha has a 1-year low of $7.33 and a 1-year high of $20.91. The stock has a market capitalization of $755.09 million, a price-to-earnings ratio of 40.18 and a beta of 1.19.

MediaAlpha (NYSE:MAX - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported $0.17 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.16 by $0.01. MediaAlpha had a negative return on equity of 46.92% and a net margin of 1.58%. The firm had revenue of $251.62 million during the quarter, compared to the consensus estimate of $248.80 million. During the same period in the prior year, the firm earned $0.07 EPS. The firm's quarterly revenue was up 41.1% compared to the same quarter last year. On average, research analysts anticipate that MediaAlpha will post 0.48 EPS for the current fiscal year.

About MediaAlpha

(

Get Free Report)

MediaAlpha, Inc, through its subsidiaries, operates an insurance customer acquisition platform in the United States. It optimizes customer acquisition in various verticals of property and casualty insurance, health insurance, and life insurance. The company was founded in 2014 and is headquartered in Los Angeles, California.

Featured Articles

Before you consider MediaAlpha, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MediaAlpha wasn't on the list.

While MediaAlpha currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.