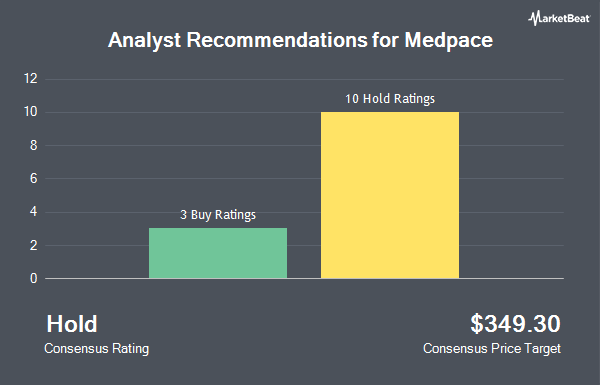

Shares of Medpace Holdings, Inc. (NASDAQ:MEDP - Get Free Report) have earned an average rating of "Reduce" from the fourteen ratings firms that are currently covering the stock, Marketbeat.com reports. Three investment analysts have rated the stock with a sell recommendation, nine have issued a hold recommendation and two have given a buy recommendation to the company. The average 12-month target price among brokerages that have updated their coverage on the stock in the last year is $406.60.

MEDP has been the subject of several analyst reports. Robert W. Baird upped their target price on Medpace from $313.00 to $490.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. TD Cowen reaffirmed a "sell" rating and issued a $366.00 target price (up previously from $283.00) on shares of Medpace in a research report on Wednesday, July 23rd. Mizuho increased their price target on Medpace from $328.00 to $510.00 and gave the company an "outperform" rating in a report on Friday, July 25th. Truist Financial increased their price target on Medpace from $298.00 to $436.00 and gave the company a "hold" rating in a report on Wednesday, July 23rd. Finally, Barclays increased their price target on Medpace from $300.00 to $450.00 and gave the company an "equal weight" rating in a report on Wednesday, July 23rd.

Get Our Latest Report on Medpace

Medpace Price Performance

Shares of NASDAQ MEDP opened at $463.64 on Monday. Medpace has a 1-year low of $250.05 and a 1-year high of $501.30. The business has a 50-day moving average of $378.86 and a 200-day moving average of $334.87. The company has a market capitalization of $13.02 billion, a price-to-earnings ratio of 34.47, a PEG ratio of 2.92 and a beta of 1.42.

Medpace (NASDAQ:MEDP - Get Free Report) last issued its earnings results on Monday, July 21st. The company reported $3.10 earnings per share for the quarter, topping the consensus estimate of $3.00 by $0.10. Medpace had a return on equity of 67.66% and a net margin of 18.74%.The company had revenue of $603.31 million during the quarter, compared to the consensus estimate of $537.70 million. During the same quarter in the prior year, the business earned $2.75 earnings per share. The company's revenue was up 14.2% compared to the same quarter last year. Medpace has set its FY 2025 guidance at 13.760-14.53 EPS. Research analysts expect that Medpace will post 12.29 EPS for the current fiscal year.

Insider Transactions at Medpace

In related news, General Counsel Stephen P. Ewald sold 3,000 shares of the stock in a transaction dated Monday, July 28th. The stock was sold at an average price of $450.00, for a total value of $1,350,000.00. Following the completion of the transaction, the general counsel owned 10,343 shares of the company's stock, valued at approximately $4,654,350. This represents a 22.48% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, VP Susan E. Burwig sold 7,500 shares of the stock in a transaction dated Monday, July 28th. The shares were sold at an average price of $450.14, for a total value of $3,376,050.00. Following the completion of the transaction, the vice president directly owned 57,500 shares of the company's stock, valued at $25,883,050. This represents a 11.54% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 114,450 shares of company stock valued at $51,791,251 in the last three months. 20.30% of the stock is currently owned by company insiders.

Institutional Trading of Medpace

Institutional investors and hedge funds have recently bought and sold shares of the company. Geneos Wealth Management Inc. raised its stake in Medpace by 64.9% during the first quarter. Geneos Wealth Management Inc. now owns 94 shares of the company's stock valued at $29,000 after buying an additional 37 shares in the last quarter. Brooklyn Investment Group raised its position in shares of Medpace by 244.8% during the 1st quarter. Brooklyn Investment Group now owns 100 shares of the company's stock worth $30,000 after purchasing an additional 71 shares during the period. Whittier Trust Co. raised its position in shares of Medpace by 47.3% during the 1st quarter. Whittier Trust Co. now owns 109 shares of the company's stock worth $33,000 after purchasing an additional 35 shares during the period. Employees Retirement System of Texas acquired a new stake in shares of Medpace during the 2nd quarter worth approximately $36,000. Finally, Colonial Trust Co SC raised its position in shares of Medpace by 150.0% during the 4th quarter. Colonial Trust Co SC now owns 175 shares of the company's stock worth $58,000 after purchasing an additional 105 shares during the period. Institutional investors and hedge funds own 77.98% of the company's stock.

About Medpace

(

Get Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.