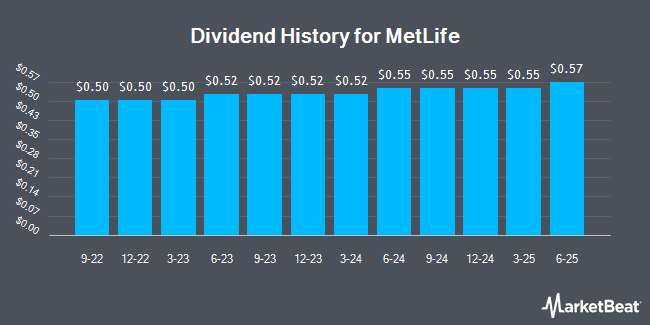

MetLife, Inc. (NYSE:MET - Get Free Report) announced a quarterly dividend on Tuesday, October 7th, RTT News reports. Shareholders of record on Tuesday, November 4th will be paid a dividend of 0.5675 per share by the financial services provider on Tuesday, December 9th. This represents a c) dividend on an annualized basis and a yield of 2.7%.

MetLife has a payout ratio of 22.0% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect MetLife to earn $10.57 per share next year, which means the company should continue to be able to cover its $2.27 annual dividend with an expected future payout ratio of 21.5%.

MetLife Trading Up 0.5%

NYSE:MET traded up $0.38 during mid-day trading on Tuesday, reaching $82.73. The company's stock had a trading volume of 2,477,772 shares, compared to its average volume of 3,407,894. The company has a debt-to-equity ratio of 0.57, a current ratio of 0.16 and a quick ratio of 0.16. MetLife has a twelve month low of $65.21 and a twelve month high of $89.05. The stock has a market cap of $55.02 billion, a P/E ratio of 14.02, a P/E/G ratio of 0.74 and a beta of 0.86. The company's fifty day simple moving average is $79.20 and its two-hundred day simple moving average is $78.14.

MetLife (NYSE:MET - Get Free Report) last released its earnings results on Wednesday, August 6th. The financial services provider reported $2.02 EPS for the quarter, missing the consensus estimate of $2.32 by ($0.30). MetLife had a net margin of 5.83% and a return on equity of 19.88%. The firm had revenue of $17.34 billion during the quarter, compared to analyst estimates of $18.58 billion. During the same period last year, the business posted $2.28 earnings per share. The firm's quarterly revenue was down 2.7% on a year-over-year basis. On average, equities analysts predict that MetLife will post 9.65 EPS for the current year.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the business. North Capital Inc. purchased a new stake in shares of MetLife in the first quarter valued at about $26,000. Quaker Wealth Management LLC increased its stake in MetLife by 198.2% during the 2nd quarter. Quaker Wealth Management LLC now owns 333 shares of the financial services provider's stock worth $27,000 after buying an additional 672 shares during the period. Motco increased its stake in MetLife by 105.5% during the 1st quarter. Motco now owns 413 shares of the financial services provider's stock worth $33,000 after buying an additional 212 shares during the period. Evolution Wealth Management Inc. purchased a new position in MetLife in the second quarter worth approximately $35,000. Finally, MTM Investment Management LLC purchased a new position in MetLife in the second quarter worth approximately $37,000. Institutional investors own 94.99% of the company's stock.

MetLife Company Profile

(

Get Free Report)

MetLife, Inc, a financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide. It operates through six segments: Retirement and Income Solutions; Group Benefits; Asia; Latin America; Europe, the Middle East and Africa; and MetLife Holdings. The company offers life, dental, group short-and long-term disability, individual disability, pet insurance, accidental death and dismemberment, vision, and accident and health coverages, as well as prepaid legal plans; administrative services-only arrangements to employers; and general and separate account, and synthetic guaranteed interest contracts, as well as private floating rate funding agreements.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MetLife, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MetLife wasn't on the list.

While MetLife currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.