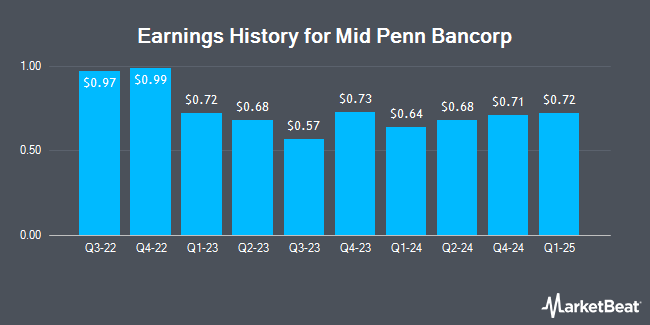

Mid Penn Bancorp (NASDAQ:MPB - Get Free Report) is expected to be posting its Q3 2025 results before the market opens on Wednesday, October 22nd. Analysts expect Mid Penn Bancorp to post earnings of $0.71 per share and revenue of $58.40 million for the quarter. Individuals are encouraged to explore the company's upcoming Q3 2025 earningoverview page for the latest details on the call scheduled for Tuesday, October 21, 2025 at 11:00 PM ET.

Mid Penn Bancorp (NASDAQ:MPB - Get Free Report) last posted its quarterly earnings data on Tuesday, September 20th. The financial services provider reported $0.97 earnings per share for the quarter. The company had revenue of $32.43 million during the quarter. Mid Penn Bancorp had a return on equity of 8.13% and a net margin of 13.69%. On average, analysts expect Mid Penn Bancorp to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Mid Penn Bancorp Stock Up 2.6%

Shares of MPB stock opened at $28.18 on Wednesday. The stock has a market cap of $648.14 million, a P/E ratio of 11.79 and a beta of 0.61. Mid Penn Bancorp has a one year low of $22.50 and a one year high of $33.87. The stock has a fifty day moving average price of $29.27 and a 200 day moving average price of $28.02. The company has a debt-to-equity ratio of 0.08, a current ratio of 0.95 and a quick ratio of 0.94.

Mid Penn Bancorp Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, August 25th. Investors of record on Friday, August 8th were given a $0.20 dividend. This represents a $0.80 annualized dividend and a yield of 2.8%. The ex-dividend date of this dividend was Friday, August 8th. Mid Penn Bancorp's dividend payout ratio (DPR) is 33.47%.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the business. Osaic Holdings Inc. raised its holdings in shares of Mid Penn Bancorp by 130.7% in the second quarter. Osaic Holdings Inc. now owns 23,824 shares of the financial services provider's stock valued at $672,000 after buying an additional 13,499 shares during the last quarter. Tower Research Capital LLC TRC raised its holdings in shares of Mid Penn Bancorp by 416.9% in the second quarter. Tower Research Capital LLC TRC now owns 3,303 shares of the financial services provider's stock valued at $93,000 after buying an additional 2,664 shares during the last quarter. Lazard Asset Management LLC raised its holdings in shares of Mid Penn Bancorp by 6.9% in the second quarter. Lazard Asset Management LLC now owns 5,576 shares of the financial services provider's stock valued at $156,000 after buying an additional 358 shares during the last quarter. Bridgeway Capital Management LLC raised its holdings in shares of Mid Penn Bancorp by 6.6% in the second quarter. Bridgeway Capital Management LLC now owns 89,620 shares of the financial services provider's stock valued at $2,527,000 after buying an additional 5,512 shares during the last quarter. Finally, Raymond James Financial Inc. raised its holdings in shares of Mid Penn Bancorp by 39.7% in the second quarter. Raymond James Financial Inc. now owns 62,174 shares of the financial services provider's stock valued at $1,753,000 after buying an additional 17,681 shares during the last quarter. 43.11% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the company. Keefe, Bruyette & Woods reduced their target price on Mid Penn Bancorp from $35.00 to $34.00 and set an "outperform" rating for the company in a research report on Monday, August 4th. Weiss Ratings reaffirmed a "hold (c+)" rating on shares of Mid Penn Bancorp in a research report on Wednesday, October 8th. Two research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company. According to data from MarketBeat.com, Mid Penn Bancorp currently has an average rating of "Moderate Buy" and a consensus price target of $34.50.

Get Our Latest Stock Report on MPB

About Mid Penn Bancorp

(

Get Free Report)

Mid Penn Bancorp, Inc operates as the bank holding company for Mid Penn Bank that provides commercial banking services to individuals, partnerships, non-profit organizations, and corporations. The company offers various time and demand deposit products, including checking accounts, savings accounts, clubs, money market deposit accounts, certificates of deposit, and individual retirement accounts.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mid Penn Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid Penn Bancorp wasn't on the list.

While Mid Penn Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.