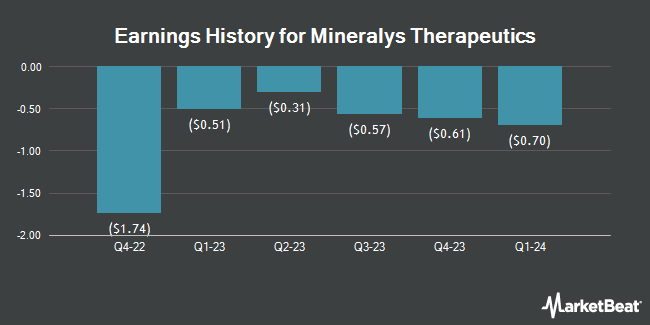

Mineralys Therapeutics (NASDAQ:MLYS - Get Free Report) posted its earnings results on Tuesday. The company reported ($0.66) EPS for the quarter, topping analysts' consensus estimates of ($0.78) by $0.12, Zacks reports.

Mineralys Therapeutics Stock Performance

MLYS traded up $0.32 during trading on Tuesday, reaching $13.51. The company's stock had a trading volume of 875,105 shares, compared to its average volume of 869,403. Mineralys Therapeutics has a 52-week low of $8.24 and a 52-week high of $18.38. The company's fifty day moving average price is $14.20 and its 200-day moving average price is $13.46. The company has a market capitalization of $880.58 million, a price-to-earnings ratio of -3.62 and a beta of -0.29.

Insider Buying and Selling at Mineralys Therapeutics

In other news, CEO Jon Congleton sold 15,884 shares of the business's stock in a transaction that occurred on Friday, July 11th. The stock was sold at an average price of $14.51, for a total transaction of $230,476.84. Following the sale, the chief executive officer owned 846,405 shares of the company's stock, valued at $12,281,336.55. The trade was a 1.84% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Adam Scott Levy sold 59,925 shares of the business's stock in a transaction that occurred on Wednesday, July 30th. The stock was sold at an average price of $14.76, for a total value of $884,493.00. Following the sale, the chief financial officer directly owned 132,934 shares in the company, valued at $1,962,105.84. This trade represents a 31.07% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 123,052 shares of company stock valued at $1,803,099. 33.24% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors have recently modified their holdings of the stock. Rhumbline Advisers raised its holdings in Mineralys Therapeutics by 36.2% in the 2nd quarter. Rhumbline Advisers now owns 53,596 shares of the company's stock valued at $725,000 after acquiring an additional 14,235 shares during the last quarter. Legal & General Group Plc boosted its position in Mineralys Therapeutics by 1,296.2% during the 2nd quarter. Legal & General Group Plc now owns 36,049 shares of the company's stock worth $488,000 after purchasing an additional 33,467 shares during the period. JPMorgan Chase & Co. boosted its position in Mineralys Therapeutics by 219.5% in the 2nd quarter. JPMorgan Chase & Co. now owns 25,500 shares of the company's stock valued at $345,000 after buying an additional 46,846 shares during the last quarter. Creative Planning purchased a new position in Mineralys Therapeutics in the 2nd quarter valued at about $336,000. Finally, Woodline Partners LP purchased a new position in Mineralys Therapeutics in the 1st quarter valued at about $757,000. 84.46% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on the company. Jefferies Financial Group assumed coverage on Mineralys Therapeutics in a research note on Tuesday, June 10th. They set a "hold" rating and a $15.00 price target for the company. Wall Street Zen lowered Mineralys Therapeutics from a "hold" rating to a "sell" rating in a report on Saturday, June 14th. HC Wainwright reaffirmed a "buy" rating and issued a $42.00 price objective on shares of Mineralys Therapeutics in a report on Tuesday, June 17th. Finally, Guggenheim set a $48.00 price objective on Mineralys Therapeutics and gave the company a "buy" rating in a report on Wednesday, May 14th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $32.25.

View Our Latest Stock Report on Mineralys Therapeutics

About Mineralys Therapeutics

(

Get Free Report)

Mineralys Therapeutics, Inc, a clinical-stage biopharmaceutical company that develops therapies for the treatment of hypertension and chronic kidney diseases. It clinical-stage product candidate is lorundrostat, a proprietary, orally administered, highly selective aldosterone synthase inhibitor for the treatment of cardiorenal conditions affected by abnormally elevated aldosterone.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mineralys Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mineralys Therapeutics wasn't on the list.

While Mineralys Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.