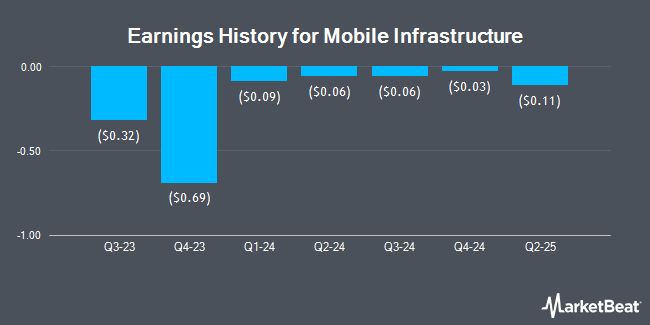

Mobile Infrastructure (NASDAQ:BEEP - Get Free Report) announced its earnings results on Tuesday. The company reported ($0.11) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.10) by ($0.01), Zacks reports. Mobile Infrastructure had a negative return on equity of 5.58% and a negative net margin of 28.91%. The company had revenue of $8.99 million for the quarter, compared to analyst estimates of $9.39 million. Mobile Infrastructure updated its FY 2025 guidance to EPS.

Mobile Infrastructure Stock Performance

NASDAQ:BEEP traded down $0.06 during trading hours on Friday, reaching $3.53. 44,053 shares of the company's stock were exchanged, compared to its average volume of 33,331. The company has a quick ratio of 0.10, a current ratio of 0.10 and a debt-to-equity ratio of 0.17. The company has a 50-day moving average of $3.98 and a 200 day moving average of $3.93. Mobile Infrastructure has a 1-year low of $2.60 and a 1-year high of $4.86. The firm has a market capitalization of $150.73 million, a price-to-earnings ratio of -11.77 and a beta of 0.55.

Wall Street Analysts Forecast Growth

Separately, Barrington Research reiterated an "outperform" rating and set a $6.50 price objective on shares of Mobile Infrastructure in a research note on Friday.

Check Out Our Latest Report on Mobile Infrastructure

Institutional Investors Weigh In On Mobile Infrastructure

Institutional investors have recently bought and sold shares of the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. bought a new stake in shares of Mobile Infrastructure during the 2nd quarter worth approximately $36,000. Raymond James Financial Inc. bought a new position in shares of Mobile Infrastructure during the 2nd quarter valued at about $39,000. JPMorgan Chase & Co. lifted its stake in shares of Mobile Infrastructure by 60,134.8% in the 2nd quarter. JPMorgan Chase & Co. now owns 13,854 shares of the company's stock valued at $63,000 after purchasing an additional 13,831 shares during the period. Focus Partners Wealth purchased a new position in Mobile Infrastructure during the first quarter valued at $80,000. Finally, New York State Common Retirement Fund purchased a new stake in shares of Mobile Infrastructure in the second quarter worth approximately $108,000. Institutional investors and hedge funds own 84.30% of the company's stock.

Mobile Infrastructure Company Profile

(

Get Free Report)

Mobile Infrastructure Corporation is a Maryland corporation. The Company owns a diversified portfolio of parking assets primarily located in the Midwest and Southwest. As of December 31, 2023, the Company owned 43 parking facilities in 21 separate markets throughout the United States, with a total of 15,700 parking spaces and approximately 5.4 million square feet.

Recommended Stories

Before you consider Mobile Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mobile Infrastructure wasn't on the list.

While Mobile Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.