Mohawk Industries (NYSE:MHK - Free Report) had its price objective upped by JPMorgan Chase & Co. from $139.00 to $140.00 in a research note published on Tuesday morning,Benzinga reports. JPMorgan Chase & Co. currently has an overweight rating on the stock.

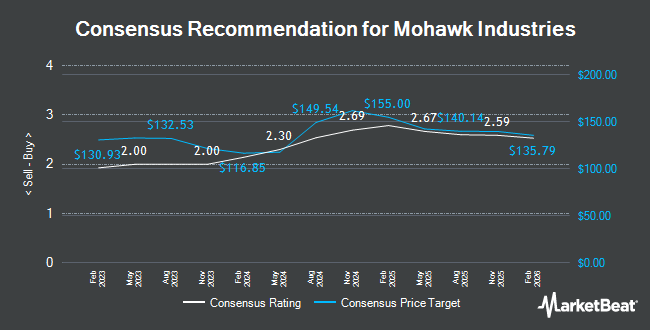

MHK has been the topic of a number of other research reports. Wells Fargo & Company raised their price objective on shares of Mohawk Industries from $105.00 to $115.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 8th. Evercore ISI reduced their target price on shares of Mohawk Industries from $124.00 to $123.00 and set an "in-line" rating for the company in a report on Monday, July 28th. Wall Street Zen cut shares of Mohawk Industries from a "buy" rating to a "hold" rating in a report on Monday, May 5th. Royal Bank Of Canada restated a "sector perform" rating and set a $123.00 target price (up from $119.00) on shares of Mohawk Industries in a report on Monday, July 28th. Finally, Deutsche Bank Aktiengesellschaft began coverage on shares of Mohawk Industries in a report on Tuesday, April 1st. They set a "hold" rating and a $121.00 target price for the company. Seven investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $140.14.

Check Out Our Latest Research Report on Mohawk Industries

Mohawk Industries Price Performance

Shares of NYSE MHK traded up $2.13 during mid-day trading on Tuesday, reaching $116.64. 939,439 shares of the company traded hands, compared to its average volume of 900,759. Mohawk Industries has a fifty-two week low of $96.24 and a fifty-two week high of $164.29. The company has a debt-to-equity ratio of 0.21, a current ratio of 2.13 and a quick ratio of 1.18. The firm has a market cap of $7.25 billion, a PE ratio of 15.51, a price-to-earnings-growth ratio of 2.49 and a beta of 1.18. The stock has a fifty day simple moving average of $107.39 and a 200-day simple moving average of $111.34.

Mohawk Industries (NYSE:MHK - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The company reported $2.77 EPS for the quarter, beating analysts' consensus estimates of $2.62 by $0.15. Mohawk Industries had a net margin of 4.44% and a return on equity of 7.30%. The business had revenue of $2.80 billion for the quarter, compared to analyst estimates of $2.76 billion. During the same quarter last year, the business earned $3.00 earnings per share. The business's revenue for the quarter was up .0% on a year-over-year basis. Equities research analysts anticipate that Mohawk Industries will post 9.8 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CEO Jeffrey S. Lorberbaum sold 16,000 shares of the firm's stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $120.81, for a total value of $1,932,960.00. Following the completion of the transaction, the chief executive officer owned 33,600 shares of the company's stock, valued at approximately $4,059,216. This trade represents a 32.26% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Suzanne L. Helen sold 2,500 shares of the firm's stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $120.60, for a total transaction of $301,500.00. Following the completion of the transaction, the insider directly owned 91,084 shares of the company's stock, valued at $10,984,730.40. This represents a 2.67% decrease in their position. The disclosure for this sale can be found here. Company insiders own 17.40% of the company's stock.

Institutional Investors Weigh In On Mohawk Industries

Institutional investors have recently modified their holdings of the stock. Federated Hermes Inc. boosted its stake in shares of Mohawk Industries by 326.3% during the 1st quarter. Federated Hermes Inc. now owns 243 shares of the company's stock valued at $28,000 after buying an additional 186 shares during the period. Resona Asset Management Co. Ltd. acquired a new stake in shares of Mohawk Industries during the 4th quarter valued at $41,000. Brooklyn Investment Group boosted its stake in shares of Mohawk Industries by 2,506.3% during the 1st quarter. Brooklyn Investment Group now owns 417 shares of the company's stock valued at $48,000 after buying an additional 401 shares during the period. Huntington National Bank raised its holdings in shares of Mohawk Industries by 27.4% during the 4th quarter. Huntington National Bank now owns 554 shares of the company's stock valued at $66,000 after purchasing an additional 119 shares in the last quarter. Finally, Allworth Financial LP raised its holdings in shares of Mohawk Industries by 36.2% during the 1st quarter. Allworth Financial LP now owns 595 shares of the company's stock valued at $65,000 after purchasing an additional 158 shares in the last quarter. Institutional investors and hedge funds own 78.98% of the company's stock.

Mohawk Industries Company Profile

(

Get Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Further Reading

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.