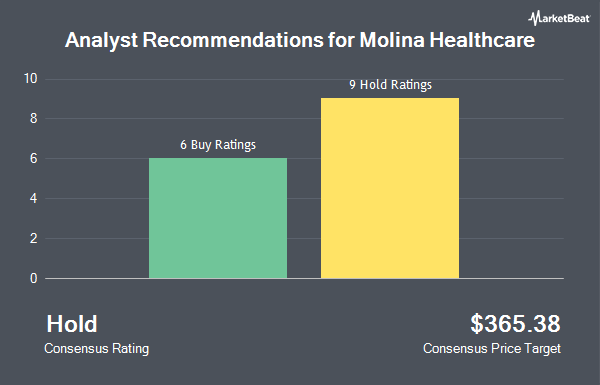

Shares of Molina Healthcare, Inc (NYSE:MOH - Get Free Report) have received a consensus recommendation of "Hold" from the sixteen research firms that are presently covering the company, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell rating, twelve have given a hold rating and three have given a buy rating to the company. The average 1-year price objective among analysts that have covered the stock in the last year is $222.1538.

MOH has been the subject of several recent analyst reports. Weiss Ratings reissued a "sell (d+)" rating on shares of Molina Healthcare in a report on Wednesday, October 8th. Morgan Stanley raised their price objective on shares of Molina Healthcare from $163.00 to $204.00 and gave the stock an "equal weight" rating in a report on Tuesday, October 14th. Truist Financial set a $210.00 price objective on shares of Molina Healthcare in a report on Tuesday, October 14th. Mizuho decreased their price objective on shares of Molina Healthcare from $400.00 to $330.00 and set an "outperform" rating for the company in a report on Friday, July 11th. Finally, Robert W. Baird decreased their price objective on shares of Molina Healthcare from $373.00 to $179.00 and set a "neutral" rating for the company in a report on Friday, July 25th.

Get Our Latest Stock Analysis on Molina Healthcare

Insider Buying and Selling at Molina Healthcare

In other Molina Healthcare news, COO James Woys purchased 10,000 shares of Molina Healthcare stock in a transaction dated Monday, August 4th. The shares were bought at an average cost of $155.94 per share, for a total transaction of $1,559,400.00. Following the transaction, the chief operating officer owned 74,331 shares in the company, valued at $11,591,176.14. This represents a 15.54% increase in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Ronna Romney sold 700 shares of the firm's stock in a transaction dated Wednesday, August 6th. The stock was sold at an average price of $153.74, for a total transaction of $107,618.00. Following the completion of the transaction, the director owned 17,131 shares in the company, valued at approximately $2,633,719.94. The trade was a 3.93% decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.26% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the business. Teacher Retirement System of Texas bought a new position in shares of Molina Healthcare in the 1st quarter worth about $2,759,000. Swedbank AB lifted its position in shares of Molina Healthcare by 6.8% in the 2nd quarter. Swedbank AB now owns 102,176 shares of the company's stock worth $30,438,000 after buying an additional 6,484 shares during the last quarter. Acadian Asset Management LLC lifted its position in shares of Molina Healthcare by 3,192.6% in the 1st quarter. Acadian Asset Management LLC now owns 5,762 shares of the company's stock worth $1,897,000 after buying an additional 5,587 shares during the last quarter. Robeco Institutional Asset Management B.V. bought a new position in shares of Molina Healthcare in the 1st quarter worth about $1,070,000. Finally, Focus Partners Advisor Solutions LLC bought a new position in shares of Molina Healthcare in the 1st quarter worth about $743,000. 98.50% of the stock is currently owned by institutional investors.

Molina Healthcare Price Performance

MOH opened at $196.82 on Wednesday. The company has a fifty day simple moving average of $183.60 and a 200 day simple moving average of $242.04. The firm has a market cap of $10.67 billion, a price-to-earnings ratio of 9.70 and a beta of 0.55. Molina Healthcare has a twelve month low of $151.95 and a twelve month high of $359.97. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.77.

Molina Healthcare (NYSE:MOH - Get Free Report) last released its quarterly earnings results on Wednesday, July 23rd. The company reported $5.48 earnings per share for the quarter, missing analysts' consensus estimates of $5.50 by ($0.02). The firm had revenue of $11.43 billion for the quarter, compared to analyst estimates of $10.94 billion. Molina Healthcare had a net margin of 2.60% and a return on equity of 27.72%. Molina Healthcare's revenue for the quarter was up 15.7% on a year-over-year basis. During the same period in the previous year, the business posted $5.86 earnings per share. Equities research analysts expect that Molina Healthcare will post 24.4 EPS for the current fiscal year.

Molina Healthcare Company Profile

(

Get Free Report)

Molina Healthcare, Inc provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments: Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Molina Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molina Healthcare wasn't on the list.

While Molina Healthcare currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.