MongoDB (NASDAQ:MDB - Free Report) had its price objective upped by Piper Sandler from $345.00 to $400.00 in a report issued on Thursday morning, Marketbeat reports. They currently have an overweight rating on the stock.

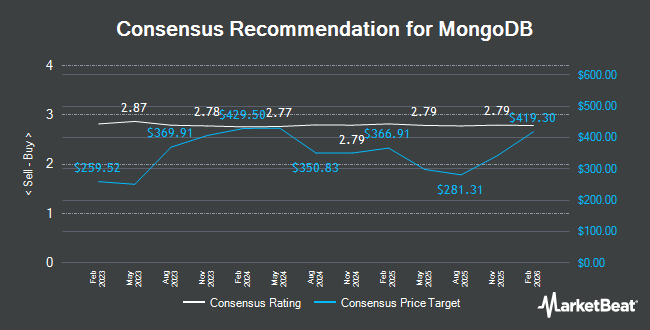

Several other equities analysts have also recently commented on the stock. Royal Bank Of Canada reissued an "outperform" rating and set a $350.00 target price on shares of MongoDB in a research report on Tuesday, September 2nd. Bank of America upped their price objective on MongoDB from $275.00 to $345.00 and gave the company a "buy" rating in a research note on Wednesday, August 27th. JMP Securities reiterated a "market outperform" rating and issued a $345.00 price objective on shares of MongoDB in a research note on Wednesday, August 27th. UBS Group upped their price objective on MongoDB from $240.00 to $310.00 and gave the company a "neutral" rating in a research note on Wednesday, August 27th. Finally, Zacks Research upgraded MongoDB to a "hold" rating in a research note on Friday, August 8th. One investment analyst has rated the stock with a Strong Buy rating, twenty-seven have issued a Buy rating and ten have issued a Hold rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $335.83.

View Our Latest Research Report on MongoDB

MongoDB Stock Performance

Shares of MongoDB stock traded up $7.13 during mid-day trading on Thursday, hitting $323.43. 3,033,722 shares of the stock were exchanged, compared to its average volume of 4,094,820. MongoDB has a 12 month low of $140.78 and a 12 month high of $370.00. The company has a 50-day simple moving average of $257.58 and a 200 day simple moving average of $211.77. The company has a market capitalization of $26.31 billion, a P/E ratio of -330.03 and a beta of 1.49.

Insider Buying and Selling at MongoDB

In other MongoDB news, Director Charles M. Hazard, Jr. sold 166 shares of the business's stock in a transaction on Tuesday, September 2nd. The shares were sold at an average price of $310.00, for a total transaction of $51,460.00. Following the sale, the director owned 14,493 shares of the company's stock, valued at $4,492,830. The trade was a 1.13% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Dwight A. Merriman sold 1,000 shares of the business's stock in a transaction on Friday, July 25th. The shares were sold at an average price of $245.00, for a total transaction of $245,000.00. Following the sale, the director directly owned 1,104,316 shares in the company, valued at $270,557,420. The trade was a 0.09% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 59,730 shares of company stock worth $16,441,331. Company insiders own 3.10% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the company. Cloud Capital Management LLC purchased a new stake in shares of MongoDB in the first quarter worth $25,000. Hollencrest Capital Management purchased a new stake in shares of MongoDB in the first quarter worth $26,000. Cullen Frost Bankers Inc. raised its position in shares of MongoDB by 315.8% in the first quarter. Cullen Frost Bankers Inc. now owns 158 shares of the company's stock worth $28,000 after buying an additional 120 shares in the last quarter. Montag A & Associates Inc. raised its position in shares of MongoDB by 144.3% in the second quarter. Montag A & Associates Inc. now owns 171 shares of the company's stock worth $36,000 after buying an additional 101 shares in the last quarter. Finally, Promus Capital LLC purchased a new stake in shares of MongoDB in the second quarter worth $36,000. Institutional investors own 89.29% of the company's stock.

MongoDB Company Profile

(

Get Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.