Starz Entertainment (NASDAQ:STRZ - Free Report) had its price target lowered by Morgan Stanley from $15.00 to $14.00 in a research note published on Friday morning, MarketBeat Ratings reports. The brokerage currently has an equal weight rating on the stock.

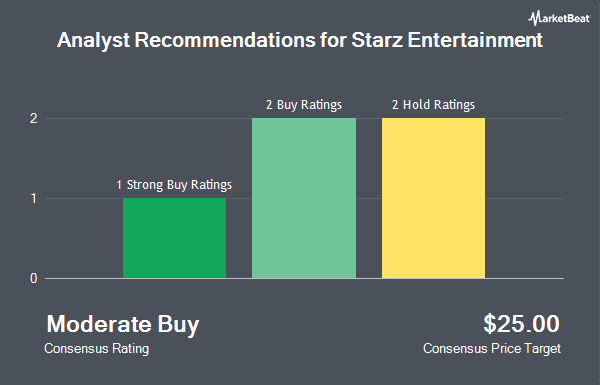

Other analysts have also recently issued reports about the company. TD Cowen raised Starz Entertainment to a "hold" rating in a report on Tuesday, May 13th. Wall Street Zen cut Starz Entertainment from a "hold" rating to a "sell" rating in a research report on Saturday, July 26th. Seaport Res Ptn raised Starz Entertainment to a "strong-buy" rating in a report on Sunday, May 18th. Benchmark started coverage on shares of Starz Entertainment in a research note on Wednesday, July 9th. They issued a "buy" rating and a $39.00 price target on the stock. Finally, Raymond James Financial reaffirmed an "outperform" rating and set a $22.00 price target (up from $19.00) on shares of Starz Entertainment in a research report on Friday, May 30th. One investment analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating and two have given a Hold rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $25.00.

Get Our Latest Stock Report on Starz Entertainment

Starz Entertainment Stock Performance

Shares of STRZ stock traded down $0.13 during midday trading on Friday, hitting $12.94. 131,613 shares of the company were exchanged, compared to its average volume of 234,967. Starz Entertainment has a 52 week low of $8.00 and a 52 week high of $22.98. The firm has a 50 day moving average price of $15.59.

Starz Entertainment (NASDAQ:STRZ - Get Free Report) last issued its quarterly earnings data on Thursday, August 14th. The company reported ($2.54) earnings per share (EPS) for the quarter, missing the consensus estimate of ($1.39) by ($1.15). The business had revenue of $319.70 million for the quarter, compared to analysts' expectations of $328.70 million.

Insider Activity

In other Starz Entertainment news, insider Warner Bros. Discovery, Inc. sold 353,334 shares of the firm's stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $14.15, for a total value of $4,999,676.10. The sale was disclosed in a document filed with the SEC, which is available at this link. Also, Director Joshua W. Sapan purchased 5,500 shares of the stock in a transaction dated Tuesday, June 3rd. The shares were bought at an average price of $17.98 per share, with a total value of $98,890.00. Following the completion of the acquisition, the director directly owned 5,500 shares of the company's stock, valued at approximately $98,890. This represents a ∞ increase in their position. The disclosure for this purchase can be found here.

Institutional Trading of Starz Entertainment

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Russell Investments Group Ltd. bought a new position in Starz Entertainment in the 2nd quarter valued at approximately $28,000. CWM LLC acquired a new position in Starz Entertainment in the 2nd quarter valued at approximately $33,000. Legal & General Group Plc acquired a new position in Starz Entertainment in the 2nd quarter valued at approximately $41,000. New York State Common Retirement Fund bought a new position in Starz Entertainment during the 2nd quarter worth $48,000. Finally, Police & Firemen s Retirement System of New Jersey bought a new stake in shares of Starz Entertainment in the 2nd quarter valued at about $49,000.

Starz Entertainment Company Profile

(

Get Free Report)

Starz is a premium cable and streaming network owned by Starz Entertainment, which was formerly a part of Lionsgate. Starz had about 20 million subscribers in the U.S. and Canada as of Dec. 31, 2024. The company's franchises include “Outlander” and “Power."

Featured Stories

Before you consider Starz Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Starz Entertainment wasn't on the list.

While Starz Entertainment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.