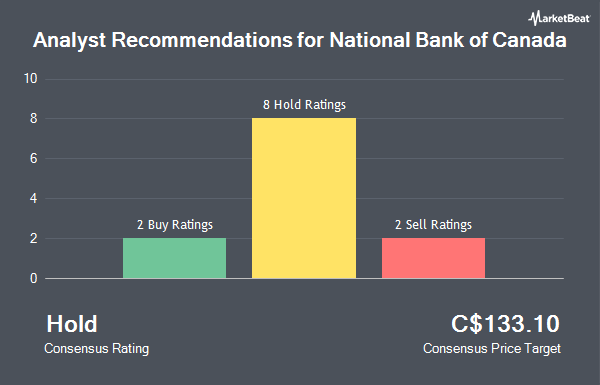

Shares of National Bank of Canada (TSE:NA - Get Free Report) have been given a consensus rating of "Hold" by the eleven ratings firms that are presently covering the company, Marketbeat.com reports. Nine equities research analysts have rated the stock with a hold recommendation and two have given a buy recommendation to the company. The average 1-year price target among analysts that have covered the stock in the last year is C$143.42.

Several equities research analysts have commented on NA shares. Cibc World Mkts raised shares of National Bank of Canada from a "strong sell" rating to a "hold" rating in a research note on Friday, August 1st. Barclays raised their price objective on National Bank of Canada from C$141.00 to C$147.00 and gave the stock an "equal weight" rating in a research note on Thursday, August 14th. CIBC boosted their target price on National Bank of Canada from C$151.00 to C$154.00 and gave the company a "neutral" rating in a research note on Friday, September 5th. Jefferies Financial Group dropped their price target on National Bank of Canada from C$157.00 to C$153.00 and set a "hold" rating on the stock in a research report on Thursday, August 28th. Finally, Royal Bank Of Canada cut their price objective on National Bank of Canada from C$152.00 to C$148.00 and set a "sector perform" rating on the stock in a report on Thursday, August 28th.

Read Our Latest Analysis on National Bank of Canada

National Bank of Canada Price Performance

Shares of National Bank of Canada stock traded up C$1.19 during trading on Friday, hitting C$149.50. 1,376,093 shares of the company were exchanged, compared to its average volume of 1,817,304. The firm has a market capitalization of C$58.60 billion, a P/E ratio of 14.73, a price-to-earnings-growth ratio of 7.14 and a beta of 1.06. The firm's fifty day moving average price is C$145.36 and its 200 day moving average price is C$131.57. National Bank of Canada has a 1-year low of C$106.67 and a 1-year high of C$151.97.

National Bank of Canada Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Saturday, November 1st. Stockholders of record on Monday, September 29th will be given a dividend of $1.18 per share. This represents a $4.72 annualized dividend and a dividend yield of 3.2%. National Bank of Canada's dividend payout ratio is 44.93%.

National Bank of Canada Company Profile

(

Get Free Report)

National Bank of Canada is the sixth-largest Canadian bank. The bank offers integrated financial services, primarily in the province of Quebec as well as the city of Toronto. Operational segments include personal and commercial banking, wealth management, and a financial markets group.

Read More

Before you consider National Bank of Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Bank of Canada wasn't on the list.

While National Bank of Canada currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.