Gildan Activewear (NYSE:GIL - Get Free Report) TSE: GIL had its price objective lifted by stock analysts at National Bankshares from $78.00 to $80.00 in a note issued to investors on Friday,BayStreet.CA reports. The firm presently has an "outperform" rating on the textile maker's stock. National Bankshares' price target suggests a potential upside of 56.99% from the company's current price.

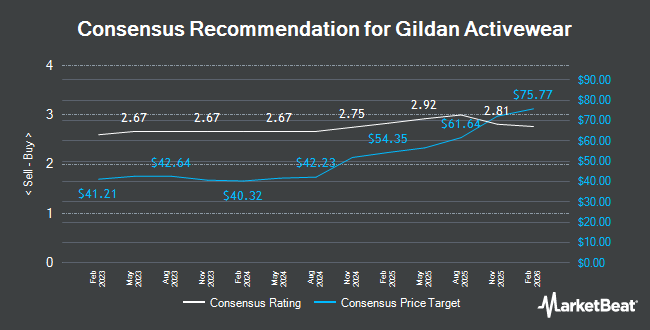

Other equities analysts have also recently issued research reports about the company. TD Securities boosted their price target on Gildan Activewear from $56.00 to $60.00 and gave the stock a "buy" rating in a report on Wednesday, April 30th. Scotiabank raised Gildan Activewear to a "strong-buy" rating and set a $55.00 target price for the company in a research note on Wednesday, May 28th. CIBC reduced their price target on shares of Gildan Activewear from $60.00 to $56.00 and set an "outperform" rating on the stock in a research note on Wednesday, April 30th. Barclays lifted their price target on shares of Gildan Activewear from $51.00 to $56.00 and gave the company an "overweight" rating in a report on Friday. Finally, UBS Group increased their price objective on shares of Gildan Activewear from $56.00 to $70.00 and gave the company a "buy" rating in a research note on Tuesday. Twelve equities research analysts have rated the stock with a buy rating, According to MarketBeat, the company currently has an average rating of "Buy" and a consensus price target of $60.58.

Read Our Latest Report on Gildan Activewear

Gildan Activewear Stock Performance

NYSE:GIL traded up $0.45 during mid-day trading on Friday, hitting $50.96. 522,925 shares of the stock were exchanged, compared to its average volume of 646,098. The firm's 50-day simple moving average is $49.44 and its 200 day simple moving average is $48.25. The stock has a market capitalization of $7.64 billion, a price-to-earnings ratio of 19.66, a price-to-earnings-growth ratio of 1.66 and a beta of 1.19. Gildan Activewear has a fifty-two week low of $37.16 and a fifty-two week high of $55.39. The company has a debt-to-equity ratio of 1.35, a quick ratio of 1.59 and a current ratio of 3.91.

Gildan Activewear (NYSE:GIL - Get Free Report) TSE: GIL last announced its quarterly earnings data on Thursday, July 31st. The textile maker reported $0.97 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.96 by $0.01. Gildan Activewear had a net margin of 12.38% and a return on equity of 30.61%. The firm had revenue of $918.50 million for the quarter, compared to the consensus estimate of $908.41 million. During the same period in the prior year, the company posted $0.74 earnings per share. The business's revenue for the quarter was up 6.5% on a year-over-year basis. As a group, equities analysts anticipate that Gildan Activewear will post 3.48 EPS for the current fiscal year.

Institutional Investors Weigh In On Gildan Activewear

Large investors have recently made changes to their positions in the company. The Manufacturers Life Insurance Company raised its position in Gildan Activewear by 276.9% in the 4th quarter. The Manufacturers Life Insurance Company now owns 1,769,634 shares of the textile maker's stock worth $83,394,000 after purchasing an additional 1,300,121 shares during the period. The Manufacturers Life Insurance Company grew its position in Gildan Activewear by 67.2% in the 1st quarter. The Manufacturers Life Insurance Company now owns 2,959,555 shares of the textile maker's stock valued at $131,556,000 after acquiring an additional 1,189,921 shares during the last quarter. Genus Capital Management Inc. increased its stake in Gildan Activewear by 191.7% in the first quarter. Genus Capital Management Inc. now owns 251,308 shares of the textile maker's stock worth $11,109,000 after purchasing an additional 525,386 shares during the period. Goldman Sachs Group Inc. boosted its position in Gildan Activewear by 40.0% in the 1st quarter. Goldman Sachs Group Inc. now owns 1,760,253 shares of the textile maker's stock valued at $77,838,000 after buying an additional 503,359 shares during the period. Finally, Millennium Management LLC grew its stake in Gildan Activewear by 5,996.0% in the 4th quarter. Millennium Management LLC now owns 466,342 shares of the textile maker's stock worth $21,935,000 after acquiring an additional 458,692 shares in the last quarter. 82.83% of the stock is owned by institutional investors.

Gildan Activewear Company Profile

(

Get Free Report)

Gildan Activewear Inc manufactures and sells various apparel products in the United States, North America, Europe, Asia-Pacific, and Latin America. It provides various activewear products, including T-shirts, fleece tops and bottoms, and sports shirts under the Gildan, Gildan Performance, Gildan Hammer, Glidan Softstyle, Gildan Heavy Cotton, Gildan Ultra Cotton, Gildan DryBlend, Gildan HeavyBlend, Comfort Colors, and American Apparel brands.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gildan Activewear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gildan Activewear wasn't on the list.

While Gildan Activewear currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.