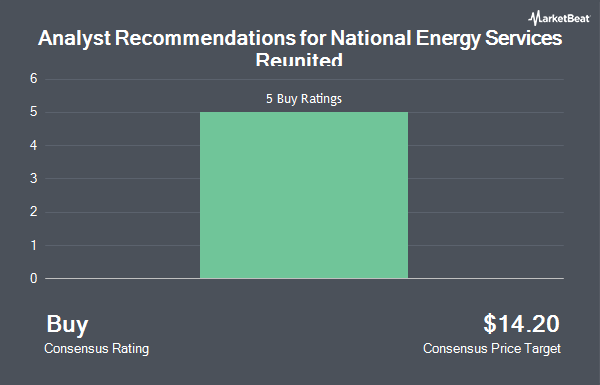

Shares of National Energy Services Reunited (NASDAQ:NESR - Get Free Report) have received an average rating of "Buy" from the six research firms that are presently covering the stock, Marketbeat reports. Six investment analysts have rated the stock with a buy rating. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $15.00.

NESR has been the subject of several research reports. Maxim Group initiated coverage on shares of National Energy Services Reunited in a research report on Tuesday, September 9th. They set a "buy" rating and a $16.00 price objective for the company. National Bankshares set a $16.00 price objective on shares of National Energy Services Reunited in a research report on Tuesday, September 9th. Piper Sandler raised their price objective on shares of National Energy Services Reunited from $11.00 to $13.00 and gave the company an "overweight" rating in a research report on Thursday, August 21st. Finally, Wall Street Zen upgraded shares of National Energy Services Reunited from a "hold" rating to a "buy" rating in a report on Monday, August 25th.

Get Our Latest Research Report on NESR

National Energy Services Reunited Trading Up 0.3%

NASDAQ NESR opened at $10.53 on Friday. National Energy Services Reunited has a 12 month low of $5.20 and a 12 month high of $10.80. The company has a debt-to-equity ratio of 0.24, a current ratio of 1.11 and a quick ratio of 0.93. The company has a market capitalization of $1.02 billion, a price-to-earnings ratio of 13.68 and a beta of 0.37. The company's fifty day moving average price is $8.39 and its two-hundred day moving average price is $7.10.

National Energy Services Reunited (NASDAQ:NESR - Get Free Report) last issued its earnings results on Wednesday, August 20th. The company reported $0.21 earnings per share for the quarter, topping analysts' consensus estimates of $0.19 by $0.02. National Energy Services Reunited had a net margin of 5.57% and a return on equity of 9.91%. The company had revenue of $327.37 million for the quarter, compared to analysts' expectations of $316.07 million. As a group, research analysts predict that National Energy Services Reunited will post 1.03 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Dodge & Cox lifted its position in National Energy Services Reunited by 201.6% during the 2nd quarter. Dodge & Cox now owns 2,136,794 shares of the company's stock worth $12,864,000 after buying an additional 1,428,200 shares in the last quarter. Geode Capital Management LLC increased its stake in shares of National Energy Services Reunited by 2,227.2% in the 2nd quarter. Geode Capital Management LLC now owns 815,209 shares of the company's stock valued at $4,908,000 after acquiring an additional 780,180 shares during the last quarter. CenterBook Partners LP bought a new stake in shares of National Energy Services Reunited in the 2nd quarter valued at about $4,562,000. MMCAP International Inc. SPC bought a new stake in shares of National Energy Services Reunited in the 2nd quarter valued at about $3,620,000. Finally, Bridgeway Capital Management LLC bought a new stake in shares of National Energy Services Reunited in the 2nd quarter valued at about $2,446,000. 15.55% of the stock is currently owned by institutional investors and hedge funds.

About National Energy Services Reunited

(

Get Free Report)

National Energy Services Reunited Corp. provides oilfield services in the Middle East and North Africa region. The company's Production Services segment offers hydraulic fracturing services; coiled tubing services, including nitrogen lifting, fishing, milling, clean-out, scale removal, and other well applications; stimulation and pumping services; primary and remedial cementing services; nitrogen services; filtration services, as well as frac tanks and pumping units; and pipeline and industrial services, such as water filling and hydro testing, nitrogen purging, and de-gassing and pressure testing, as well as cutting/welding and cooling down piping/vessels systems.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider National Energy Services Reunited, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Energy Services Reunited wasn't on the list.

While National Energy Services Reunited currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.