Maxim Group initiated coverage on shares of National Energy Services Reunited (NASDAQ:NESR - Free Report) in a research note released on Tuesday, Marketbeat Ratings reports. The brokerage issued a buy rating and a $16.00 price objective on the stock.

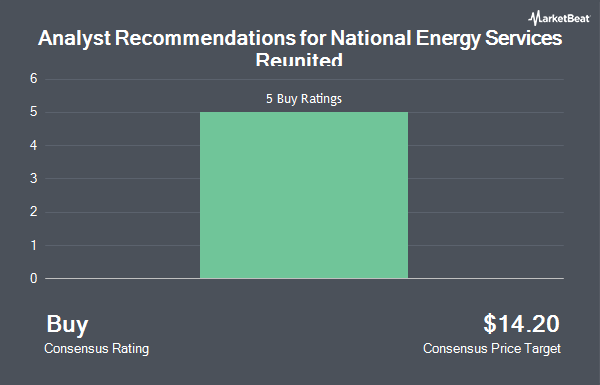

A number of other research firms have also recently issued reports on NESR. Piper Sandler upped their price target on shares of National Energy Services Reunited from $11.00 to $13.00 and gave the company an "overweight" rating in a report on Thursday, August 21st. Wall Street Zen raised shares of National Energy Services Reunited from a "hold" rating to a "buy" rating in a research report on Monday, August 25th. Six equities research analysts have rated the stock with a Buy rating, Based on data from MarketBeat, the company has an average rating of "Buy" and an average target price of $15.00.

Read Our Latest Stock Analysis on NESR

National Energy Services Reunited Stock Down 0.9%

Shares of NASDAQ NESR traded down $0.09 during mid-day trading on Tuesday, reaching $10.25. The company had a trading volume of 757,480 shares, compared to its average volume of 839,127. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.93 and a current ratio of 1.11. The stock has a market capitalization of $988.61 million, a PE ratio of 13.31 and a beta of 0.37. National Energy Services Reunited has a twelve month low of $5.20 and a twelve month high of $10.50. The stock's 50 day moving average is $7.55 and its 200-day moving average is $6.93.

National Energy Services Reunited (NASDAQ:NESR - Get Free Report) last posted its earnings results on Wednesday, August 20th. The company reported $0.21 EPS for the quarter, topping the consensus estimate of $0.19 by $0.02. The firm had revenue of $327.37 million for the quarter, compared to the consensus estimate of $316.07 million. National Energy Services Reunited had a net margin of 5.57% and a return on equity of 9.91%. As a group, equities analysts anticipate that National Energy Services Reunited will post 1.03 earnings per share for the current fiscal year.

Institutional Trading of National Energy Services Reunited

Hedge funds have recently modified their holdings of the company. Iridian Asset Management LLC CT increased its holdings in shares of National Energy Services Reunited by 78.1% during the first quarter. Iridian Asset Management LLC CT now owns 273,944 shares of the company's stock worth $2,016,000 after buying an additional 120,108 shares in the last quarter. Millennium Management LLC acquired a new stake in shares of National Energy Services Reunited in the fourth quarter valued at approximately $3,515,000. Bank of America Corp DE acquired a new stake in shares of National Energy Services Reunited in the fourth quarter valued at approximately $1,208,000. Penn Capital Management Company LLC increased its holdings in shares of National Energy Services Reunited by 111.9% in the first quarter. Penn Capital Management Company LLC now owns 87,630 shares of the company's stock valued at $645,000 after purchasing an additional 46,276 shares in the last quarter. Finally, Ameriprise Financial Inc. acquired a new stake in shares of National Energy Services Reunited in the fourth quarter valued at approximately $1,162,000. Institutional investors and hedge funds own 15.55% of the company's stock.

National Energy Services Reunited Company Profile

(

Get Free Report)

National Energy Services Reunited Corp. provides oilfield services in the Middle East and North Africa region. The company's Production Services segment offers hydraulic fracturing services; coiled tubing services, including nitrogen lifting, fishing, milling, clean-out, scale removal, and other well applications; stimulation and pumping services; primary and remedial cementing services; nitrogen services; filtration services, as well as frac tanks and pumping units; and pipeline and industrial services, such as water filling and hydro testing, nitrogen purging, and de-gassing and pressure testing, as well as cutting/welding and cooling down piping/vessels systems.

Read More

Before you consider National Energy Services Reunited, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Energy Services Reunited wasn't on the list.

While National Energy Services Reunited currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.