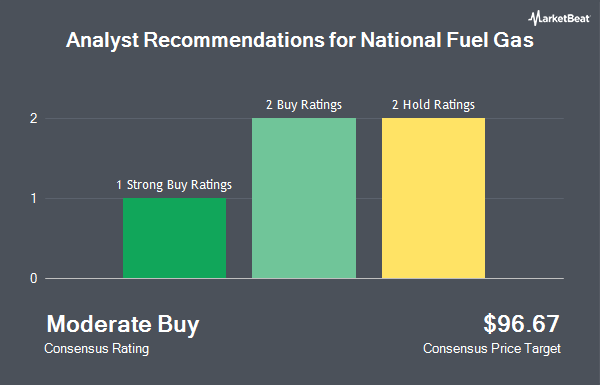

National Fuel Gas Company (NYSE:NFG - Get Free Report) has earned a consensus rating of "Moderate Buy" from the five research firms that are presently covering the firm, MarketBeat reports. Two investment analysts have rated the stock with a hold recommendation, two have assigned a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1 year target price among brokers that have issued ratings on the stock in the last year is $96.6667.

A number of analysts recently issued reports on NFG shares. Scotiabank restated an "outperform" rating on shares of National Fuel Gas in a research report on Wednesday, August 13th. Wall Street Zen downgraded National Fuel Gas from a "buy" rating to a "hold" rating in a research report on Sunday, August 10th. Zacks Research lowered National Fuel Gas from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 18th. Finally, Bank of America upgraded National Fuel Gas from an "underperform" rating to a "buy" rating and increased their target price for the stock from $85.00 to $107.00 in a research note on Tuesday, July 15th.

Check Out Our Latest Stock Report on NFG

Hedge Funds Weigh In On National Fuel Gas

Several institutional investors have recently made changes to their positions in NFG. Mariner LLC increased its stake in shares of National Fuel Gas by 1.3% during the fourth quarter. Mariner LLC now owns 20,291 shares of the oil and gas producer's stock valued at $1,231,000 after buying an additional 258 shares during the period. Jump Financial LLC purchased a new position in shares of National Fuel Gas during the fourth quarter valued at $380,000. Dimensional Fund Advisors LP boosted its position in National Fuel Gas by 4.6% during the fourth quarter. Dimensional Fund Advisors LP now owns 989,487 shares of the oil and gas producer's stock valued at $60,043,000 after purchasing an additional 43,656 shares in the last quarter. Natixis bought a new stake in National Fuel Gas during the fourth quarter valued at about $1,043,000. Finally, MetLife Investment Management LLC boosted its position in National Fuel Gas by 9.1% during the fourth quarter. MetLife Investment Management LLC now owns 51,493 shares of the oil and gas producer's stock valued at $3,125,000 after purchasing an additional 4,281 shares in the last quarter. Hedge funds and other institutional investors own 73.96% of the company's stock.

National Fuel Gas Price Performance

Shares of NFG traded down $0.4670 during mid-day trading on Wednesday, hitting $86.7530. 397,545 shares of the stock were exchanged, compared to its average volume of 641,833. The company has a market cap of $7.84 billion, a PE ratio of 32.61, a price-to-earnings-growth ratio of 0.51 and a beta of 0.65. The firm has a 50-day moving average of $86.07 and a two-hundred day moving average of $80.72. National Fuel Gas has a 52-week low of $58.50 and a 52-week high of $89.82. The company has a debt-to-equity ratio of 0.80, a quick ratio of 0.39 and a current ratio of 0.46.

National Fuel Gas (NYSE:NFG - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The oil and gas producer reported $1.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.50 by $0.14. The company had revenue of $531.83 million during the quarter, compared to the consensus estimate of $596.12 million. National Fuel Gas had a return on equity of 20.81% and a net margin of 11.15%.National Fuel Gas's revenue was up 27.4% on a year-over-year basis. During the same period last year, the company earned $0.99 earnings per share. National Fuel Gas has set its FY 2026 guidance at 8.000-8.500 EPS. FY 2025 guidance at 6.800-6.950 EPS. On average, equities analysts predict that National Fuel Gas will post 6.64 earnings per share for the current year.

National Fuel Gas Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were paid a dividend of $0.535 per share. This is an increase from National Fuel Gas's previous quarterly dividend of $0.52. This represents a $2.14 annualized dividend and a dividend yield of 2.5%. The ex-dividend date was Monday, June 30th. National Fuel Gas's payout ratio is 80.45%.

National Fuel Gas Company Profile

(

Get Free Report)

National Fuel Gas Company operates as a diversified energy company. It operates through four segments: Exploration and Production, Pipeline and Storage, Gathering, and Utility. The Exploration and Production segment explores for, develops, and produces natural gas and oil. The Pipeline and Storage segment provides interstate natural gas transportation services through an integrated gas pipeline system in Pennsylvania and New York; and owns and operates underground natural gas storage fields.

Featured Stories

Before you consider National Fuel Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Fuel Gas wasn't on the list.

While National Fuel Gas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.