National Vision (NASDAQ:EYE - Get Free Report) has been assigned a $27.00 price objective by research analysts at Wells Fargo & Company in a research note issued to investors on Thursday, Marketbeat.com reports. The firm currently has an "equal weight" rating on the stock. Wells Fargo & Company's target price would indicate a potential upside of 16.28% from the stock's previous close.

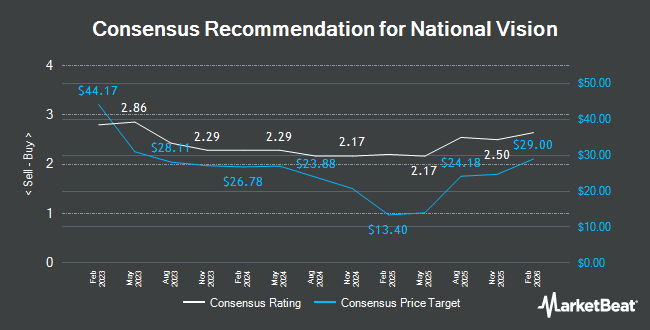

Several other equities research analysts have also recently weighed in on the company. Loop Capital upped their target price on National Vision from $18.00 to $20.00 and gave the stock a "buy" rating in a research note on Thursday, May 8th. BMO Capital Markets set a $19.00 price target on National Vision and gave the company a "market perform" rating in a research note on Monday, May 19th. The Goldman Sachs Group raised their price objective on National Vision from $13.00 to $17.00 and gave the company a "neutral" rating in a report on Friday, May 9th. UBS Group reissued a "buy" rating and set a $30.00 price objective on shares of National Vision in a report on Tuesday, July 8th. Finally, Bank of America raised their price objective on National Vision from $22.00 to $26.00 and gave the company a "buy" rating in a report on Wednesday, June 18th. Four research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat, National Vision currently has a consensus rating of "Moderate Buy" and a consensus price target of $24.73.

Check Out Our Latest Stock Analysis on National Vision

National Vision Stock Performance

Shares of National Vision stock traded up $0.20 on Thursday, hitting $23.22. The stock had a trading volume of 1,738,836 shares, compared to its average volume of 2,197,860. National Vision has a twelve month low of $9.56 and a twelve month high of $25.67. The business's 50 day moving average is $23.64 and its two-hundred day moving average is $17.06. The company has a quick ratio of 0.31, a current ratio of 0.52 and a debt-to-equity ratio of 0.30. The stock has a market cap of $1.84 billion, a price-to-earnings ratio of -129.00, a price-to-earnings-growth ratio of 2.77 and a beta of 1.27.

National Vision (NASDAQ:EYE - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported $0.18 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.12 by $0.06. The business had revenue of $486.42 million for the quarter, compared to the consensus estimate of $469.21 million. National Vision had a positive return on equity of 3.56% and a negative net margin of 0.75%. The firm's quarterly revenue was up 7.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.15 earnings per share. Analysts forecast that National Vision will post 0.31 EPS for the current year.

Hedge Funds Weigh In On National Vision

Several hedge funds have recently modified their holdings of EYE. ProShare Advisors LLC raised its holdings in shares of National Vision by 44.4% in the 4th quarter. ProShare Advisors LLC now owns 23,480 shares of the company's stock worth $245,000 after purchasing an additional 7,221 shares during the period. Janney Montgomery Scott LLC bought a new stake in shares of National Vision in the 1st quarter worth approximately $467,000. GAMMA Investing LLC raised its holdings in shares of National Vision by 49.2% in the 1st quarter. GAMMA Investing LLC now owns 7,318 shares of the company's stock worth $94,000 after purchasing an additional 2,412 shares during the period. SG Americas Securities LLC raised its holdings in shares of National Vision by 282.5% in the 1st quarter. SG Americas Securities LLC now owns 75,843 shares of the company's stock worth $969,000 after purchasing an additional 56,017 shares during the period. Finally, Point72 Asset Management L.P. bought a new stake in shares of National Vision in the 4th quarter worth approximately $860,000.

National Vision Company Profile

(

Get Free Report)

National Vision Holdings, Inc, through its subsidiaries, operates as an optical retailer in the United States. The company operates in two segments, Owned & Host and Legacy. It offers eyeglasses and contact lenses, and optical accessory products; provides eye exams through its America's Best, Eyeglass World, Vista Optical, Fred Meyer, and Vista Optical military, as well as Vision Center branded stores; and offers health maintenance organization and optometric services.

See Also

Before you consider National Vision, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Vision wasn't on the list.

While National Vision currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.