Taysha Gene Therapies (NASDAQ:TSHA - Get Free Report) had its price target upped by Needham & Company LLC from $8.00 to $10.00 in a research note issued to investors on Thursday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Needham & Company LLC's price objective points to a potential upside of 124.97% from the company's previous close.

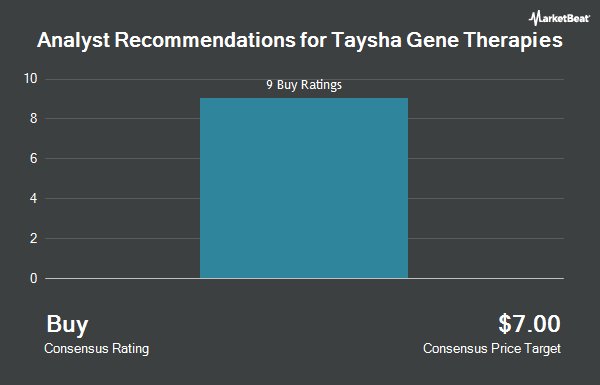

TSHA has been the subject of a number of other reports. Wells Fargo & Company upped their price target on shares of Taysha Gene Therapies from $7.50 to $8.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 13th. Chardan Capital upped their price target on shares of Taysha Gene Therapies from $9.00 to $10.00 and gave the stock a "buy" rating in a research note on Tuesday, August 12th. Finally, Bank of America began coverage on shares of Taysha Gene Therapies in a research note on Friday, July 11th. They issued a "buy" rating and a $8.00 price target for the company. Eight analysts have rated the stock with a Buy rating, Based on data from MarketBeat, Taysha Gene Therapies has a consensus rating of "Buy" and an average price target of $8.57.

Read Our Latest Research Report on TSHA

Taysha Gene Therapies Stock Performance

Taysha Gene Therapies stock traded up $1.27 during midday trading on Thursday, reaching $4.45. 76,164,560 shares of the stock traded hands, compared to its average volume of 3,423,694. The company has a current ratio of 12.48, a quick ratio of 12.48 and a debt-to-equity ratio of 0.17. The firm has a fifty day moving average price of $2.94 and a two-hundred day moving average price of $2.43. The firm has a market cap of $1.21 billion, a price-to-earnings ratio of -13.14 and a beta of 0.99. Taysha Gene Therapies has a fifty-two week low of $1.05 and a fifty-two week high of $4.83.

Taysha Gene Therapies (NASDAQ:TSHA - Get Free Report) last posted its earnings results on Tuesday, August 12th. The company reported ($0.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.07) by ($0.02). The firm had revenue of $1.99 million for the quarter, compared to analyst estimates of $1.61 million. Taysha Gene Therapies had a negative net margin of 1,144.97% and a negative return on equity of 78.44%. On average, equities research analysts forecast that Taysha Gene Therapies will post -0.35 earnings per share for the current year.

Insider Activity

In other news, insider Sukumar Nagendran sold 200,000 shares of the business's stock in a transaction that occurred on Wednesday, September 10th. The shares were sold at an average price of $3.23, for a total transaction of $646,000.00. Following the sale, the insider owned 1,006,439 shares in the company, valued at $3,250,797.97. The trade was a 16.58% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 3.78% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Taysha Gene Therapies

A number of large investors have recently made changes to their positions in the company. Octagon Capital Advisors LP raised its holdings in shares of Taysha Gene Therapies by 17.7% during the second quarter. Octagon Capital Advisors LP now owns 12,592,500 shares of the company's stock valued at $29,089,000 after acquiring an additional 1,892,500 shares during the period. Jefferies Financial Group Inc. grew its position in Taysha Gene Therapies by 4,105.3% during the second quarter. Jefferies Financial Group Inc. now owns 10,313,733 shares of the company's stock valued at $23,825,000 after purchasing an additional 10,068,479 shares in the last quarter. Adage Capital Partners GP L.L.C. purchased a new position in Taysha Gene Therapies during the second quarter valued at approximately $11,178,000. Tybourne Capital Management HK Ltd. grew its position in Taysha Gene Therapies by 10.7% during the second quarter. Tybourne Capital Management HK Ltd. now owns 4,095,000 shares of the company's stock valued at $9,459,000 after purchasing an additional 395,000 shares in the last quarter. Finally, Geode Capital Management LLC grew its position in Taysha Gene Therapies by 3.5% during the second quarter. Geode Capital Management LLC now owns 3,793,572 shares of the company's stock valued at $8,765,000 after purchasing an additional 128,840 shares in the last quarter. Institutional investors and hedge funds own 77.70% of the company's stock.

Taysha Gene Therapies Company Profile

(

Get Free Report)

Taysha Gene Therapies, Inc, a gene therapy company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system. It primarily develops TSHA-120 for the treatment of giant axonal neuropathy; TSHA-102 for the treatment of Rett syndrome; TSHA-121 for the treatment of CLN7 disease; TSHA-118 for the treatment of CLN1 disease; TSHA-105 for the treatment of for SLC13A5 deficiency; TSHA-113 for the treatment of tauopathies; TSHA-106 for the treatment of angelman syndrome; TSHA-114 for the treatment of fragile X syndrome; and TSHA-101 for the treatment of GM2 gangliosidosis.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Taysha Gene Therapies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taysha Gene Therapies wasn't on the list.

While Taysha Gene Therapies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.