Needham & Company LLC reiterated their buy rating on shares of Compass (NYSE:COMP - Free Report) in a research note published on Thursday morning,Benzinga reports. They currently have a $11.00 price objective on the stock.

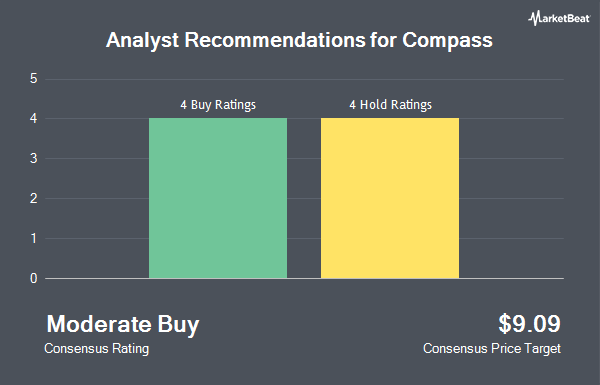

COMP has been the topic of a number of other research reports. Wells Fargo & Company cut their target price on shares of Compass from $8.00 to $7.00 and set an "equal weight" rating on the stock in a report on Monday, July 7th. Oppenheimer reiterated an "outperform" rating and issued a $12.00 target price (down from $13.00) on shares of Compass in a report on Friday, May 9th. Morgan Stanley decreased their target price on shares of Compass from $8.50 to $8.00 and set an "equal weight" rating for the company in a research note on Friday, May 9th. UBS Group lowered their price target on Compass from $12.00 to $11.00 and set a "buy" rating on the stock in a report on Friday, April 11th. Finally, Compass Point set a $9.00 price objective on Compass in a research report on Monday, June 30th. Three research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $9.44.

Get Our Latest Research Report on Compass

Compass Price Performance

Compass stock traded down $0.13 during midday trading on Thursday, hitting $7.81. 14,812,948 shares of the company were exchanged, compared to its average volume of 6,997,391. The company's fifty day moving average price is $6.48 and its 200-day moving average price is $7.37. Compass has a fifty-two week low of $3.84 and a fifty-two week high of $10.25. The company has a market cap of $4.07 billion, a PE ratio of -78.09 and a beta of 2.61.

Compass (NYSE:COMP - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $0.07 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.07. The company had revenue of $2.06 billion for the quarter, compared to the consensus estimate of $2.08 billion. Compass had a negative return on equity of 10.83% and a negative net margin of 0.85%. On average, analysts expect that Compass will post 0.09 EPS for the current fiscal year.

Compass Company Profile

(

Get Free Report)

Compass, Inc provides real estate brokerage services in the United States. It operates a cloud-based platform that provides an integrated suite of software for customer relationship management, marketing, client service, operations, and other functionality in the real estate industry. The company offers mobile apps that allow agents to manage their business anytime and anywhere, as well as designs consumer-grade user interfaces, automated and simplified workflows for agent-client interactions, and insight-rich dashboards and reports.

Featured Articles

Before you consider Compass, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass wasn't on the list.

While Compass currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.