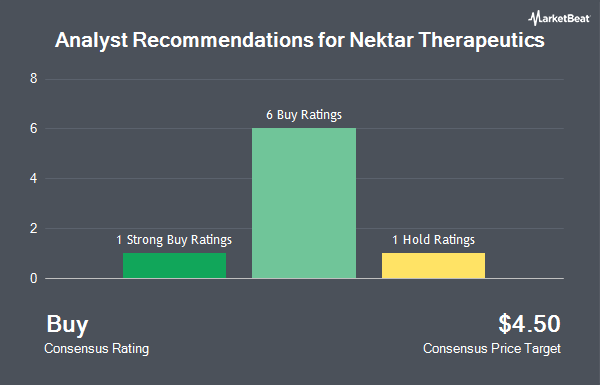

Nektar Therapeutics (NASDAQ:NKTR - Get Free Report) has earned an average recommendation of "Moderate Buy" from the seven research firms that are covering the stock, Marketbeat.com reports. One investment analyst has rated the stock with a hold recommendation and six have assigned a buy recommendation to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $88.3333.

NKTR has been the subject of several analyst reports. B. Riley upped their target price on shares of Nektar Therapeutics from $60.00 to $85.00 and gave the company a "buy" rating in a research note on Tuesday, July 8th. BTIG Research reiterated a "buy" rating and set a $100.00 price objective on shares of Nektar Therapeutics in a research note on Friday. Finally, HC Wainwright increased their price objective on shares of Nektar Therapeutics to $120.00 and gave the company a "buy" rating in a research note on Tuesday, June 24th.

Get Our Latest Analysis on Nektar Therapeutics

Insiders Place Their Bets

In other Nektar Therapeutics news, CEO Howard W. Robin sold 6,666 shares of the stock in a transaction on Tuesday, September 9th. The shares were sold at an average price of $46.69, for a total transaction of $311,235.54. Following the transaction, the chief executive officer directly owned 49,342 shares in the company, valued at $2,303,777.98. This represents a 11.90% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Jonathan Zalevsky sold 1,721 shares of the stock in a transaction on Thursday, September 4th. The shares were sold at an average price of $33.52, for a total transaction of $57,687.92. Following the transaction, the insider owned 17,462 shares in the company, valued at $585,326.24. This trade represents a 8.97% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 25,178 shares of company stock worth $938,776 over the last quarter. 3.71% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in NKTR. FNY Investment Advisers LLC acquired a new position in shares of Nektar Therapeutics in the second quarter worth about $39,000. Headlands Technologies LLC acquired a new position in shares of Nektar Therapeutics in the second quarter worth about $65,000. IFP Advisors Inc acquired a new position in shares of Nektar Therapeutics in the second quarter worth about $124,000. Northern Trust Corp boosted its holdings in shares of Nektar Therapeutics by 0.9% in the fourth quarter. Northern Trust Corp now owns 1,414,984 shares of the biopharmaceutical company's stock worth $1,316,000 after buying an additional 12,826 shares during the period. Finally, Marshall Wace LLP acquired a new position in shares of Nektar Therapeutics in the second quarter worth about $367,000. 75.88% of the stock is currently owned by institutional investors.

Nektar Therapeutics Stock Performance

Shares of NKTR stock traded up $0.30 on Friday, hitting $59.19. The stock had a trading volume of 455,556 shares, compared to its average volume of 905,772. The firm has a market capitalization of $1.13 billion, a price-to-earnings ratio of -6.68 and a beta of 1.05. The stock's 50 day moving average is $31.59 and its 200-day moving average is $19.31. Nektar Therapeutics has a 52-week low of $6.45 and a 52-week high of $61.06.

Nektar Therapeutics (NASDAQ:NKTR - Get Free Report) last announced its earnings results on Thursday, August 7th. The biopharmaceutical company reported ($2.95) earnings per share for the quarter, beating the consensus estimate of ($3.13) by $0.18. The business had revenue of $11.18 million during the quarter, compared to the consensus estimate of $9.42 million. Nektar Therapeutics had a negative net margin of 163.17% and a negative return on equity of 631.43%. Equities analysts expect that Nektar Therapeutics will post -0.72 earnings per share for the current year.

Nektar Therapeutics Company Profile

(

Get Free Report)

Nektar Therapeutics, a biopharmaceutical company, focuses on discovering and developing medicines in the field of immunotherapy in the United States and internationally. The company is developing rezpegaldesleukin, a cytokine Treg stimulant that is in phase 2 clinical trial for the treatment of systemic lupus erythematosus and ulcerative colitis, as well as phase 2b clinical trial to treat atopic dermatitis and psoriasis; and NKTR-255, an IL-15 receptor agonist, which is in phase 1 clinical trial to boost the immune system's natural ability to fight cancer.

Featured Articles

Before you consider Nektar Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nektar Therapeutics wasn't on the list.

While Nektar Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.