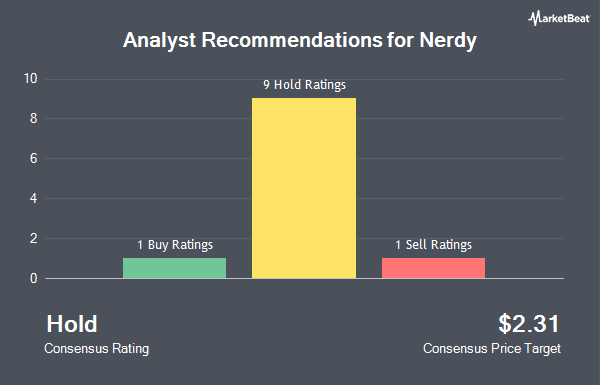

Shares of Nerdy Inc. (NYSE:NRDY - Get Free Report) have been assigned a consensus rating of "Reduce" from the seven brokerages that are currently covering the stock, Marketbeat reports. Two research analysts have rated the stock with a sell recommendation, four have issued a hold recommendation and one has issued a buy recommendation on the company. The average 1 year target price among brokerages that have issued a report on the stock in the last year is $1.75.

A number of analysts have commented on the stock. Wall Street Zen lowered shares of Nerdy from a "hold" rating to a "sell" rating in a research note on Friday, September 5th. Cantor Fitzgerald reduced their price objective on shares of Nerdy from $1.75 to $1.50 and set a "neutral" rating for the company in a research note on Friday, August 8th. Finally, Weiss Ratings reaffirmed a "sell (e+)" rating on shares of Nerdy in a research note on Wednesday, October 8th.

Read Our Latest Stock Analysis on NRDY

Insider Transactions at Nerdy

In other Nerdy news, Director Abigail Blunt acquired 25,000 shares of the business's stock in a transaction that occurred on Friday, August 29th. The shares were purchased at an average price of $1.36 per share, with a total value of $34,000.00. Following the completion of the transaction, the director owned 226,000 shares in the company, valued at $307,360. The trade was a 12.44% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, insider Christopher C. Swenson sold 37,845 shares of Nerdy stock in a transaction that occurred on Monday, August 18th. The shares were sold at an average price of $1.27, for a total transaction of $48,063.15. Following the completion of the transaction, the insider directly owned 1,556,825 shares in the company, valued at approximately $1,977,167.75. This represents a 2.37% decrease in their position. The disclosure for this sale can be found here. Insiders sold 139,853 shares of company stock valued at $177,613 over the last three months. 50.94% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Nerdy

A number of institutional investors have recently modified their holdings of NRDY. Cambridge Investment Research Advisors Inc. bought a new position in shares of Nerdy in the first quarter valued at approximately $26,000. Voya Investment Management LLC bought a new position in Nerdy during the first quarter worth $30,000. AQR Capital Management LLC increased its position in Nerdy by 67.9% during the first quarter. AQR Capital Management LLC now owns 37,660 shares of the company's stock worth $53,000 after acquiring an additional 15,234 shares during the period. Strs Ohio bought a new position in Nerdy during the first quarter worth $56,000. Finally, Bank of America Corp DE increased its position in Nerdy by 41.9% during the fourth quarter. Bank of America Corp DE now owns 60,565 shares of the company's stock worth $98,000 after acquiring an additional 17,889 shares during the period. Institutional investors own 39.10% of the company's stock.

Nerdy Trading Down 0.4%

NYSE:NRDY opened at $1.17 on Wednesday. Nerdy has a twelve month low of $0.75 and a twelve month high of $2.18. The company has a 50-day moving average of $1.28 and a 200-day moving average of $1.48. The firm has a market cap of $216.46 million, a price-to-earnings ratio of -2.99 and a beta of 1.84.

Nerdy (NYSE:NRDY - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The company reported ($0.07) earnings per share for the quarter, beating the consensus estimate of ($0.10) by $0.03. Nerdy had a negative net margin of 24.91% and a negative return on equity of 77.11%. The company had revenue of $45.26 million during the quarter, compared to analyst estimates of $46.60 million. Nerdy has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. On average, research analysts forecast that Nerdy will post -0.43 earnings per share for the current year.

Nerdy Company Profile

(

Get Free Report)

Nerdy, Inc operates platform for live online learning. The company's purpose-built proprietary platform leverages technology, including artificial intelligence to connect students, users, parents, guardians, and purchasers of various ages to tutors, instructors, subject matter experts, educators, and other professionals, delivering value on both sides of the network.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nerdy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nerdy wasn't on the list.

While Nerdy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.