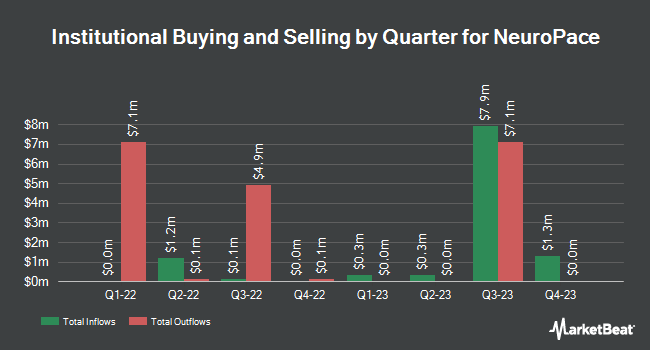

JPMorgan Chase & Co. increased its holdings in NeuroPace, Inc. (NASDAQ:NPCE - Free Report) by 440.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 64,826 shares of the company's stock after acquiring an additional 52,829 shares during the period. JPMorgan Chase & Co. owned about 0.22% of NeuroPace worth $725,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds also recently bought and sold shares of the business. Palumbo Wealth Management LLC purchased a new stake in shares of NeuroPace during the 4th quarter worth about $129,000. Barclays PLC increased its holdings in NeuroPace by 346.0% in the third quarter. Barclays PLC now owns 20,633 shares of the company's stock worth $144,000 after buying an additional 16,007 shares during the last quarter. Financial Advocates Investment Management raised its position in NeuroPace by 27.8% during the fourth quarter. Financial Advocates Investment Management now owns 23,000 shares of the company's stock valued at $257,000 after acquiring an additional 5,000 shares in the last quarter. Bank of New York Mellon Corp lifted its stake in NeuroPace by 21.2% in the fourth quarter. Bank of New York Mellon Corp now owns 29,342 shares of the company's stock valued at $328,000 after acquiring an additional 5,133 shares during the last quarter. Finally, State Street Corp grew its position in NeuroPace by 9.1% in the third quarter. State Street Corp now owns 155,490 shares of the company's stock worth $1,084,000 after acquiring an additional 12,912 shares in the last quarter. Hedge funds and other institutional investors own 78.83% of the company's stock.

NeuroPace Price Performance

NPCE stock traded down $0.09 during trading on Monday, hitting $11.89. 6,843 shares of the stock traded hands, compared to its average volume of 131,619. The stock has a market cap of $389.43 million, a price-to-earnings ratio of -11.88 and a beta of 2.03. The company has a 50 day simple moving average of $11.57 and a 200 day simple moving average of $11.11. The company has a current ratio of 5.59, a quick ratio of 4.77 and a debt-to-equity ratio of 6.03. NeuroPace, Inc. has a one year low of $5.45 and a one year high of $15.11.

NeuroPace (NASDAQ:NPCE - Get Free Report) last issued its quarterly earnings data on Tuesday, March 4th. The company reported ($0.18) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.25) by $0.07. The firm had revenue of $21.47 million during the quarter, compared to the consensus estimate of $21.14 million. NeuroPace had a negative return on equity of 205.41% and a negative net margin of 36.74%. Equities analysts expect that NeuroPace, Inc. will post -1 EPS for the current fiscal year.

Insider Activity

In other news, insider Martha Morrell sold 78,334 shares of NeuroPace stock in a transaction on Friday, February 21st. The stock was sold at an average price of $13.72, for a total value of $1,074,742.48. Following the completion of the sale, the insider now directly owns 81,993 shares of the company's stock, valued at approximately $1,124,943.96. This trade represents a 48.86 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, major shareholder Ltd. Kck sold 5,270,845 shares of the firm's stock in a transaction dated Thursday, February 20th. The shares were sold at an average price of $9.40, for a total value of $49,545,943.00. The disclosure for this sale can be found here. 22.20% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

NPCE has been the topic of a number of recent research reports. Wells Fargo & Company raised their price target on shares of NeuroPace from $13.00 to $17.00 and gave the company an "overweight" rating in a report on Thursday, January 30th. Cantor Fitzgerald boosted their price objective on NeuroPace from $19.00 to $20.00 and gave the stock an "overweight" rating in a research report on Wednesday, March 5th. Finally, UBS Group started coverage on shares of NeuroPace in a research note on Tuesday, January 21st. They issued a "buy" rating and a $17.00 target price for the company. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, NeuroPace currently has an average rating of "Moderate Buy" and a consensus target price of $15.20.

Check Out Our Latest Stock Report on NeuroPace

NeuroPace Company Profile

(

Free Report)

NeuroPace, Inc operates as a medical device company in the United States. The company develops RNS system, a brain-responsive neuromodulation system that delivers personalized, real-time treatment at the seizure source for treating medically refractory focal epilepsy. It also records continuous brain activity data and enables clinicians to monitor patients in person and remotely.

Read More

Before you consider NeuroPace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeuroPace wasn't on the list.

While NeuroPace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.