NewEdge Advisors LLC increased its stake in shares of Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 25.2% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 18,114 shares of the technology company's stock after purchasing an additional 3,647 shares during the quarter. NewEdge Advisors LLC's holdings in Check Point Software Technologies were worth $3,382,000 as of its most recent filing with the Securities and Exchange Commission.

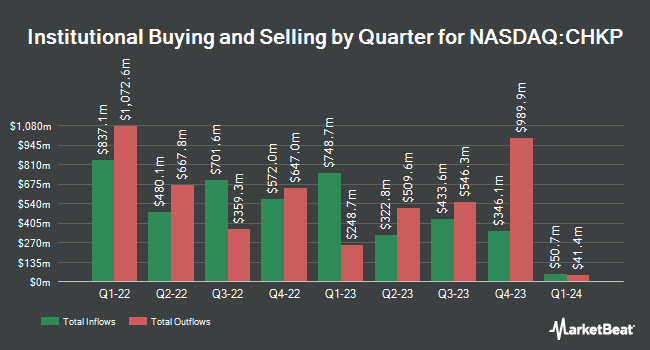

Other institutional investors have also recently added to or reduced their stakes in the company. Nemes Rush Group LLC acquired a new position in shares of Check Point Software Technologies in the fourth quarter valued at approximately $25,000. GAMMA Investing LLC raised its holdings in Check Point Software Technologies by 53.1% in the 4th quarter. GAMMA Investing LLC now owns 173 shares of the technology company's stock valued at $32,000 after acquiring an additional 60 shares during the last quarter. Golden State Wealth Management LLC purchased a new position in shares of Check Point Software Technologies during the 4th quarter worth $35,000. Strategic Financial Concepts LLC acquired a new stake in shares of Check Point Software Technologies during the fourth quarter worth $35,000. Finally, Exchange Traded Concepts LLC lifted its position in Check Point Software Technologies by 142.7% during the fourth quarter. Exchange Traded Concepts LLC now owns 233 shares of the technology company's stock worth $44,000 after buying an additional 137 shares during the period. Institutional investors and hedge funds own 98.51% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently issued reports on the stock. Compass Point set a $260.00 target price on shares of Check Point Software Technologies in a report on Thursday, March 27th. Stephens decreased their price objective on shares of Check Point Software Technologies from $255.00 to $229.00 and set an "equal weight" rating for the company in a research report on Thursday. JPMorgan Chase & Co. upgraded shares of Check Point Software Technologies from a "neutral" rating to an "overweight" rating and lifted their price target for the stock from $221.00 to $255.00 in a research note on Wednesday, February 26th. Cantor Fitzgerald restated a "neutral" rating and set a $200.00 price objective on shares of Check Point Software Technologies in a research note on Monday, January 27th. Finally, Robert W. Baird raised shares of Check Point Software Technologies from a "neutral" rating to an "outperform" rating and lifted their price target for the company from $235.00 to $255.00 in a report on Thursday, February 27th. Eighteen equities research analysts have rated the stock with a hold rating, eleven have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, Check Point Software Technologies presently has a consensus rating of "Hold" and a consensus price target of $232.04.

Read Our Latest Report on CHKP

Check Point Software Technologies Stock Performance

Shares of Check Point Software Technologies stock traded down $2.33 on Friday, reaching $206.55. The stock had a trading volume of 715,082 shares, compared to its average volume of 775,531. The business's 50-day moving average price is $220.45 and its two-hundred day moving average price is $202.01. The stock has a market cap of $22.72 billion, a P/E ratio of 27.65, a price-to-earnings-growth ratio of 3.41 and a beta of 0.62. Check Point Software Technologies Ltd. has a fifty-two week low of $145.75 and a fifty-two week high of $234.36.

Check Point Software Technologies Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Further Reading

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.