News (NASDAQ:NWSA - Get Free Report)'s stock had its "neutral" rating reiterated by research analysts at Macquarie in a research report issued to clients and investors on Wednesday, Marketbeat.com reports. They presently have a $32.70 target price on the stock. Macquarie's target price suggests a potential upside of 11.11% from the company's current price.

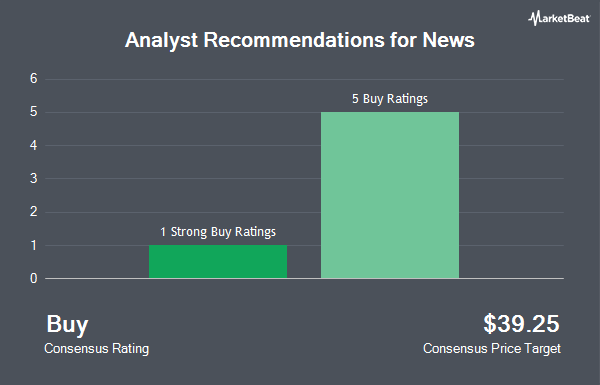

Other equities analysts also recently issued research reports about the company. Guggenheim reiterated a "buy" rating and issued a $45.00 price objective on shares of News in a research note on Thursday, May 15th. Wall Street Zen downgraded shares of News from a "buy" rating to a "hold" rating in a report on Friday, May 30th. Finally, Morgan Stanley reduced their target price on shares of News from $38.00 to $37.00 and set an "overweight" rating for the company in a research note on Friday, April 11th. Two research analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, News currently has an average rating of "Moderate Buy" and an average price target of $38.12.

View Our Latest Stock Analysis on News

News Stock Performance

NWSA stock traded up $0.14 during midday trading on Wednesday, hitting $29.43. The company's stock had a trading volume of 6,538,791 shares, compared to its average volume of 3,295,438. News has a 1 year low of $23.38 and a 1 year high of $30.75. The stock has a market cap of $16.66 billion, a price-to-earnings ratio of 34.22 and a beta of 1.23. The stock's 50-day moving average price is $28.92 and its 200 day moving average price is $28.03. The company has a quick ratio of 1.60, a current ratio of 1.68 and a debt-to-equity ratio of 0.21.

News (NASDAQ:NWSA - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The company reported $0.19 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.19. The business had revenue of $2.11 billion during the quarter, compared to the consensus estimate of $2.09 billion. News had a net margin of 5.18% and a return on equity of 5.64%. The firm's quarterly revenue was up .8% compared to the same quarter last year. During the same quarter last year, the company posted $0.17 earnings per share. On average, equities analysts forecast that News will post 0.94 EPS for the current year.

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the business. Public Employees Retirement System of Ohio boosted its position in News by 0.3% during the second quarter. Public Employees Retirement System of Ohio now owns 126,293 shares of the company's stock valued at $3,753,000 after buying an additional 344 shares during the period. Signaturefd LLC increased its stake in shares of News by 3.5% in the first quarter. Signaturefd LLC now owns 11,833 shares of the company's stock worth $322,000 after buying an additional 398 shares during the period. Horizon Investments LLC raised its holdings in News by 7.7% during the 1st quarter. Horizon Investments LLC now owns 5,575 shares of the company's stock valued at $152,000 after buying an additional 398 shares during the last quarter. Franklin Resources Inc. grew its holdings in News by 1.9% in the 4th quarter. Franklin Resources Inc. now owns 21,962 shares of the company's stock worth $605,000 after acquiring an additional 418 shares during the last quarter. Finally, Boyar Asset Management Inc. increased its holdings in News by 2.9% during the 4th quarter. Boyar Asset Management Inc. now owns 15,203 shares of the company's stock valued at $419,000 after purchasing an additional 422 shares during the period. 66.97% of the stock is owned by hedge funds and other institutional investors.

About News

(

Get Free Report)

News Corporation, a media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses worldwide. It operates through six segments: Digital Real Estate Services, Subscription Video Services, Dow Jones, Book Publishing, News Media, and Other.

See Also

Before you consider News, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and News wasn't on the list.

While News currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.