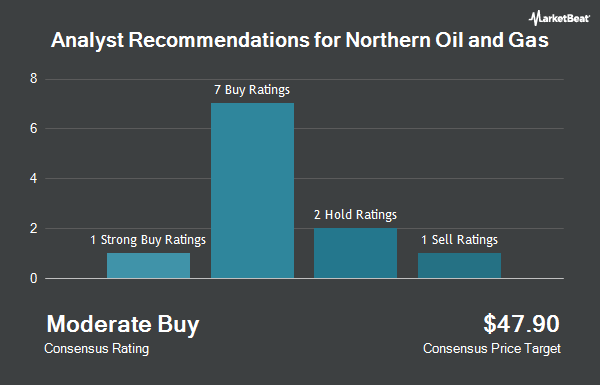

Shares of Northern Oil and Gas, Inc. (NYSE:NOG - Get Free Report) have been assigned an average rating of "Moderate Buy" from the eleven ratings firms that are currently covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, four have given a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. The average 12 month price target among brokers that have issued a report on the stock in the last year is $36.4444.

A number of equities analysts have issued reports on NOG shares. Bank of America increased their target price on Northern Oil and Gas from $29.00 to $33.00 and gave the stock a "buy" rating in a report on Friday, May 23rd. Piper Sandler restated a "neutral" rating and issued a $25.00 price objective (down previously from $31.00) on shares of Northern Oil and Gas in a report on Monday, August 4th. Morgan Stanley cut Northern Oil and Gas from a "positive" rating to an "underweight" rating and decreased their price objective for the company from $29.00 to $27.00 in a report on Monday, August 18th. William Blair assumed coverage on Northern Oil and Gas in a report on Monday, August 25th. They issued an "outperform" rating for the company. Finally, Mizuho decreased their price objective on Northern Oil and Gas from $32.00 to $28.00 and set a "neutral" rating for the company in a report on Monday.

Check Out Our Latest Stock Analysis on NOG

Hedge Funds Weigh In On Northern Oil and Gas

Several hedge funds have recently modified their holdings of NOG. Pinnacle Holdings LLC bought a new position in Northern Oil and Gas during the first quarter worth about $28,000. MassMutual Private Wealth & Trust FSB grew its holdings in Northern Oil and Gas by 133.3% during the second quarter. MassMutual Private Wealth & Trust FSB now owns 954 shares of the company's stock worth $27,000 after purchasing an additional 545 shares during the period. UMB Bank n.a. grew its holdings in Northern Oil and Gas by 200.3% during the second quarter. UMB Bank n.a. now owns 955 shares of the company's stock worth $27,000 after purchasing an additional 637 shares during the period. Laurel Wealth Advisors LLC grew its holdings in Northern Oil and Gas by 2,736.1% during the second quarter. Laurel Wealth Advisors LLC now owns 1,021 shares of the company's stock worth $29,000 after purchasing an additional 985 shares during the period. Finally, Signaturefd LLC grew its holdings in Northern Oil and Gas by 60.0% during the first quarter. Signaturefd LLC now owns 1,080 shares of the company's stock worth $33,000 after purchasing an additional 405 shares during the period. Institutional investors own 98.80% of the company's stock.

Northern Oil and Gas Stock Up 1.7%

NOG stock traded up $0.43 during trading hours on Friday, reaching $26.30. 1,736,551 shares of the stock were exchanged, compared to its average volume of 1,382,998. The firm's 50-day moving average is $26.09 and its 200-day moving average is $27.09. The company has a market cap of $2.57 billion, a price-to-earnings ratio of 4.34 and a beta of 1.67. The company has a debt-to-equity ratio of 0.98, a current ratio of 1.21 and a quick ratio of 1.21. Northern Oil and Gas has a 12 month low of $19.88 and a 12 month high of $44.31.

Northern Oil and Gas (NYSE:NOG - Get Free Report) last released its earnings results on Thursday, July 31st. The company reported $1.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.87 by $0.50. The firm had revenue of $706.81 million during the quarter, compared to analysts' expectations of $555.54 million. Northern Oil and Gas had a return on equity of 22.12% and a net margin of 23.62%.The company's revenue was up 26.0% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.46 EPS. On average, equities research analysts expect that Northern Oil and Gas will post 5.18 earnings per share for the current year.

Northern Oil and Gas Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, October 31st. Stockholders of record on Monday, September 29th will be issued a $0.45 dividend. The ex-dividend date is Monday, September 29th. This represents a $1.80 annualized dividend and a dividend yield of 6.8%. Northern Oil and Gas's dividend payout ratio (DPR) is presently 29.70%.

About Northern Oil and Gas

(

Get Free Report)

Northern Oil and Gas, Inc, an independent energy company, engages in the acquisition, exploration, exploitation, development, and production of crude oil and natural gas properties in the United States. It primarily holds interests in the Williston Basin, the Appalachian Basin, and the Permian Basin in the United States.

Further Reading

Before you consider Northern Oil and Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Oil and Gas wasn't on the list.

While Northern Oil and Gas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.